Press Release

Triple Lock only gives pensioners £2 extra per week

04 May 2017 - Estimated reading time: 3 minutes

Key points:

- Basic state pension is £122.30 per week in 2017/18, but would be £120.26 pw if double lock had been used and £115.28 pw if based solely on price inflation

- Compared to a double lock, the triple has cost the government £1.8-2 billion over the last seven years. This is insignificant compared to the £8 billion per year which will ultimately be saved by the introduction of the new Single Tier

- Lower income pensioners who rely mostly on state pension would be worst hit the removal of the triple lock

- If the triple lock is removed state pensions will still need to increase faster than inflation or earnings as we are not saving enough for retirement

- Given future market expectations of inflation, it’s difficult to see the triple lock having a significant impact over the course of the next Parliament

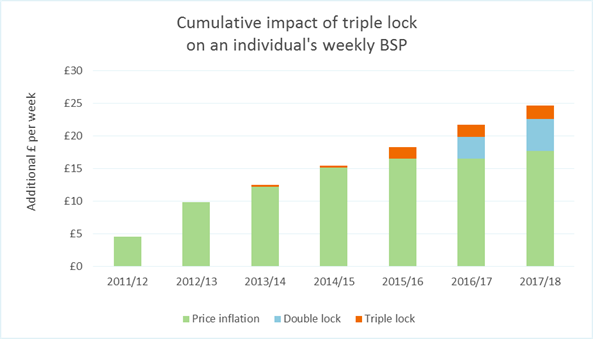

State Pensioners get £2.04 per week more from the implementation of triple lock, than from the double lock, and £7.02 more than if the pension was based solely on price inflation according to Hymans Robertson, the leading pensions and benefits consultancy. While these extra pounds mean a lot to the recipients, such figures would be insignificant to government costs weighed up against the political impact of removing the triple lock. It would also have the biggest impact on the low paid who rely more on state pension.

Hymans Robertson analysis looked at the £97.65 per week state pension in 2010/11 and calculated what would have happened in three scenarios. It would have increased as follows by 2017/18:

- £115.28 per week based solely on price inflation – (i.e. £17.63 pw higher)

- £120.26 per week if using a double lock of the higher of price inflation and earnings – (another £4.98 pw)

- £122.30 per week if using a triple lock (as is the case in reality) – (i.e. an additional £2.04 pw)

Discussing the cost of the triple lock to Government, Chris Noon, Partner, Hymans Robertson said:

“The total cost of the triple lock since its introduction seven years ago has been in the region of £1.8-£2 billion. This is because there were three years (2013, 2015 and 2017) where the 2.5% underpin has applied. Given market expectations of inflation, it’s difficult to see a scenario where the cost of the triple lock is at all significant over the course of the next Parliament. The political risk may simply not be worth taking.”

Commenting on the political implications he added:

“If the triple lock was removed and replaced by a double lock policy it would be based on a need for short-term cashflow rather than thoughtful policy decision-making. As part of the introduction of the new state pension, the Government considered the cost of the triple lock. Their analysis showed that even with the triple lock in place, the long-term cost of the new state pension is £8bn a year less than previous arrangements. The £1.8bn-£2bn cost of the triple lock over the last 7 years is minimal compared to this £8bn a year saving.”

“It would also impact the lowest paid most as they rely more, and sometimes solely, on the state pension. Its value will simply erode over time significantly reducing the cash they have to live on. This was the section of the population that was most negatively affected by the changes introduced with the new state pension, so removing the triple lock would be a major blow for them.”

Any changes to the state pension must be seen in the context of a looming savings crisis where the state pension will have to increase at a higher rate than earnings Hymans Robertson warns.

Explaining why the state pension will be under pressure to increase at a rate faster than inflation or earnings, he said:

“The fact is that state pension will have to increase at a higher rate than earnings in the long-term. Chronic under saving in the UK means that there will be an increased reliance on state pension. The pressure on the state will increase considerably as we see greater numbers retire with DC pensions over the coming years as three quarters of DC savers will not be able to retire on an adequate income. It will be politically unacceptable to have vast numbers of individuals below pensioner poverty levels of income.

Concluding, he said:

“As there are about 10 million* voters in receipt of state pension, it seems politically and economically more sensible to maintain the triple lock. At the very least for the course of the next Parliament.”

0 comments on this post