OUR ROUND-UP OF THE LATEST PUBLIC SECTOR NEWS AND INSIGHTS

Current issues in the LGPS - April 2024

03 Apr 2024

A bumper edition this month as we enter the new financial year. For example, you can delve into hot topics such as ‘natural capital’ or ‘partial cessations’, or catch up on the key issues that affect the pensions accounting disclosures of local authorities at this year end. Happy reading!

A new era of funding for the LGPS?

The countdown clock is now less than 12 months so minds in England & Wales will be turning to the 2025 valuations. At the recent LGC Carden Park conference (highlights here), we discussed how the significant shift in the economic environment since 2022 means that LGPS funds, no matter their beliefs about how this change affects funding levels, now need to start thinking about their funding and investment strategy. We’ll shortly be sharing an article about this; the first of three pieces focussing on what this change in environment may mean for LGPS funding.

Seeing the woods for the trees

Natural capital has been gaining a lot of attention recently, being seen as an investment opportunity that offers ways to address climate change and biodiversity issues whilst still generating a return. Our first article helps to explain what this is and the areas to consider – look out for more coming shortly.

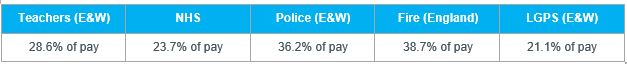

Valuation results for other public sector pension schemes

The end of 2023 saw a flurry of activity in the unfunded public service pension scheme world as the results of their 2020 valuations were published. The results set out the employer costs of these schemes from 1 April 2024. The table below summarises these costs, alongside a comparison of the average rate currently being paid by LGPS employers. The valuation reports also confirmed that there will be no change to members’ benefits or employee contribution rates in these schemes because of the 2020 cost management review (the results of the LGPS assessment are still to be published – see next section).

Cost management in the LGPS

The LGPS still awaits the results of its 2020 cost control mechanism, although the wait shouldn’t be much longer. At the English & Welsh SAB’s March meeting, the results of the SAB cost management were being considered, with the meeting paper proposing no changes to member benefits. The paper also noted that the results of the HMT LGPS cost management review should be available and published ‘in the coming weeks’. If you would like more information about cost management, this House of Commons Library Research Briefing may be helpful.

The Spring Budget

The Spring Budget threw out two key developments for LGPS investments. The first was an indication of a requirement to report on the level of investment in UK equities, with wording stating that if this reporting does not lead to increased investment, stricter rules may be brought in. The second was a surprise announcement of the potential for the LGPS to assist in financing the building of 200 new children’s homes, with more detail on that expected shortly. These both, in spirit, follow on from the consultation launched last year, but are perhaps surprising that they focus in on UK equities and children's homes specifically, which had not previously been identified as key areas for the government. Our summary of the Budget announcements on pensions is covered here.

The General Code is here – are you ready?

As you read this article, the Pension Regulator’s General Code of Practice (GCOP) will have been ‘activated’ and apply in practice to the UK pensions industry. Our team have been supporting funds through our self-assessment GCOP LGPS checker tool and committee, board, and officer training sessions. Crucially, we will be providing ongoing support to officers by independently scrutinising the self-assessed GCOP position of funds. This gives funds the assurance that they have solutions and timescales in place to meet GCOP compliance levels and are ready if they get a visit from TPR! If you would like to discuss any of these areas of support or the GCOP checker tool for your fund, please contact Andrew.Mckerns@hymans.co.uk or Alan.Johnson@hymans.co.uk.

2023 valuations

31 March 2024 is a date that chocolate lovers were eagerly anticipating, but for LGPS fund officers and actuaries in Scotland, this date has meant only one thing: the official end to the 2023 actuarial valuations! Across the board Scottish LGPS funds have reported improvements in funding position (with an average funding level of 141% across the funds advised by Hymans Robertson). For many employers, this has meant a welcome reduction in contribution rates at a time when there is significant pressure on employer budgets – a very positive set of results overall. We would like to thank fund officers for all their assistance through the valuation exercise which (like all valuation exercises!) has brought its own unique set of challenges. Look out for our 2023 valuation ‘Big Picture’ report, which will be published in early April, for more details on the funding picture for the LGPS in Scotland.

What makes a good mortality projection model?

The Continuous Mortality Investigation (CMI) publishes it's own mortality projections model, which has become the industry standard in the UK for setting future life expectancy projections. The CMI recently carried out a consultation on its proposals for the next version of its mortality projections model (‘CMI_2023’), which is due to be published in the coming weeks. What makes a good mortality projection model? And what are the practical challenges when predicting life expectancies for members of the LGPS? Read Club Vita's latest blog to find out more.

Partial cessations in the LGPS

In response to changing market conditions, some LGPS employers (and their advisors) have been asking funds to facilitate a partial cessation, where the non-active liabilities are ‘ceased’ and transferred back to the fund, while the active liabilities remain the responsibility of the employer. This reduces the employer’s risk exposure and allows active members to remain in the fund. However, there are very few incidences of LGPS funds agreeing to a partial cessation approach. Our 60-Second Summary explains how partial cessation could be implemented and summarises initial considerations for funds.

Navigating the 2024 LGPS accounting disclosures

As we gear up for another busy year of LGPS accounting, we hosted a webinar for LGPS officers on 26 March (with attendees from more than 60 funds). For those unable to attend on the day (or keen to watch again!) this is available to watch on-demand here. Feel free to share with anyone involved in the year-end exercises including employers and auditors. There are also two recent consultations (both closed in March 2024) that are looking at potential changes to simplify local authority financial reporting, one of which could impact the 31 March 2024 year end (for local authorities in England). While we await the outcomes of each, the CIPFA/LASAAC consultation can be found here and the DLUHC consultation here. Please get in touch with our specialists at LGPSCentralAccounting@hymans.co.uk with any accounting questions.

The risk of ‘climate ruin’

A recent report from the Institute & Faculty of Actuaries has provided further insight on the current state of our climate and highlighted the need for actuaries and others to reflect climate uncertainty in their modelling. Whilst noting that warming had breached the 1.5-degree threshold during 2023, the report also noted the importance of considering interconnected societal, natural, climate and economic risks and the potential emergence of tipping points. Decision makers are encouraged to ensure that a broad range of outcomes are explored including realistic “worst case” scenarios.

Events, webinars & training

Together, stepping into the future of the LGPS: 16 May

Spaces for our LGPS conference on 16 May 2024 in Edinburgh are filling up. The event, which is for LGPS fund officers only, will have a future focus, underpinned by sharing experience, best practice and actionable outputs. You can view the conference agenda here.

LGPS employer training

The next block of our employer training sessions is taking place this month and will focus on final pay and assumed pensionable pay and will include dedicated worked example sessions. You can register interest here, or if you have any questions, please get in touch with Claire McDines.

In brief…

Inflation figures

The latest ONS release showed that CPI for the year to February 2024 fell to 3.4% (from 4.0% the prior month). RPI for the same period was 4.5%. Our latest InflationWatch provides further context.

Social investing

The Taskforce on Social Factors has produced guidance on considering social factors in pension scheme investments, with recommendations, a section on stewardship, and case studies.

Public finances

The Office for Budget Responsibility (OBR) issued its latest economic and fiscal outlook alongside the Spring Budget, including forecasts for the economy, receipts and public spending in the UK over the next five years.

McCloud

A trio of items this month!

- Directions – the Treasury has published Directions, and correspondence about the interest rate approach, relating to the operation of the remedy for McCloud discrimination in the public service schemes.

- Briefing paper – the House of Common library has updated its research briefing on the judgment.

- Transfer calculator – LGA have released a spreadsheet that allows Scottish funds to calculate the McCloud element of a non-Club transfer value. It applies to calculations with a relevant date between 1 October 2023 and 31 March 2024.

Dashboards

And another trio!

- FAQ’s - the Pension Dashboards Programme (PDP) has published a blog covering some commonly asked questions, about timescales for value data, user consent and responsibility for AVC data.

- Consultation - the FCA has launched a further consultation on the regulatory framework for pensions dashboard service firms.

- Staging dates - the DWP has published guidance on the staging timetable for connection to pensions dashboards. Public service schemes such as the LGPS have a spooky connection date of 31 October 2025.

Annual update

LGA’s annual bulletin sets out the rates and bands that apply from April 2024 for various purposes including LGPS employee contributions.

Pensions taxation

The Pensions (Abolition of Lifetime Allowance Charge etc) Regulations 2024 (SI 2024 No. 356) make numerous changes to the tax legislation in an attempt to patch deficiencies in the Finance Act 2024's lifetime allowance abolition provisions. LGA have published an administrator guide on the ‘Abolition of the LTA’, together with a draft ‘Previous pension benefits declaration form’ (E&W here and Scotland here) although they note that further clarity to rectify contradictions and confirm policy intent in the legislation and HMRC guidance is awaited.

Women’s State Pension age

The Parliamentary and Health Service Ombudsman has published its conclusions about the DWP's communication of changes to State Pension age for women born after 5 April 1950. In short, it has found that there was maladministration resulting in lost opportunities (but no direct financial losses) and has asked Parliament to intervene to provide a suitable remedy (at level 4 in its severity of injustice scale: £1,000 to £2,950, reflecting 'significant and/or lasting injustice').

FRS102 reporting

The FRC has published amendments to FRS 102 arising from a periodic (quinquennial) review of the reporting standard. The amendments to Section 28 (Employee Benefits) start on page 152. They're effective for accounting periods beginning on or after 1 January 2026.

General Code of Practice

New legislation formally brings the Pensions Regulator's General Code of Practice into force on 28 March 2024. It also revokes historical statutory instruments related to the old, withdrawn Codes.

If you have any questions, or would like to discuss anything further, please get in touch.

0 comments on this post