Mortgage payments, utility bills, National Insurance. They’re all going up. What about pension contributions?

22 Feb 2022

Household budgets are being pinched by staggering rises in the cost of living, and this can be seen in soaring utility bills alongside an impending rise in National Insurance contribution rates amongst other things. With inflation reaching a 30-year high in December 2021 at 7.51, it’s no surprise that around half (47%) of people who are not yet retired say they can’t afford to save at the moment (January 2022)2. This is worrying for many reasons, but one which may have longer-term implications is that people might consider cutting their pension contributions.

Choosing to reduce your pension contributions is a significant decision that should only be made with careful thought, particularly if this decision is being made without financial advice. This is because even a relatively minor reduction in pension contributions can, all else remaining equal, lead to a significant change to the lifestyle that can then be afforded in retirement. This is especially true for younger savers.

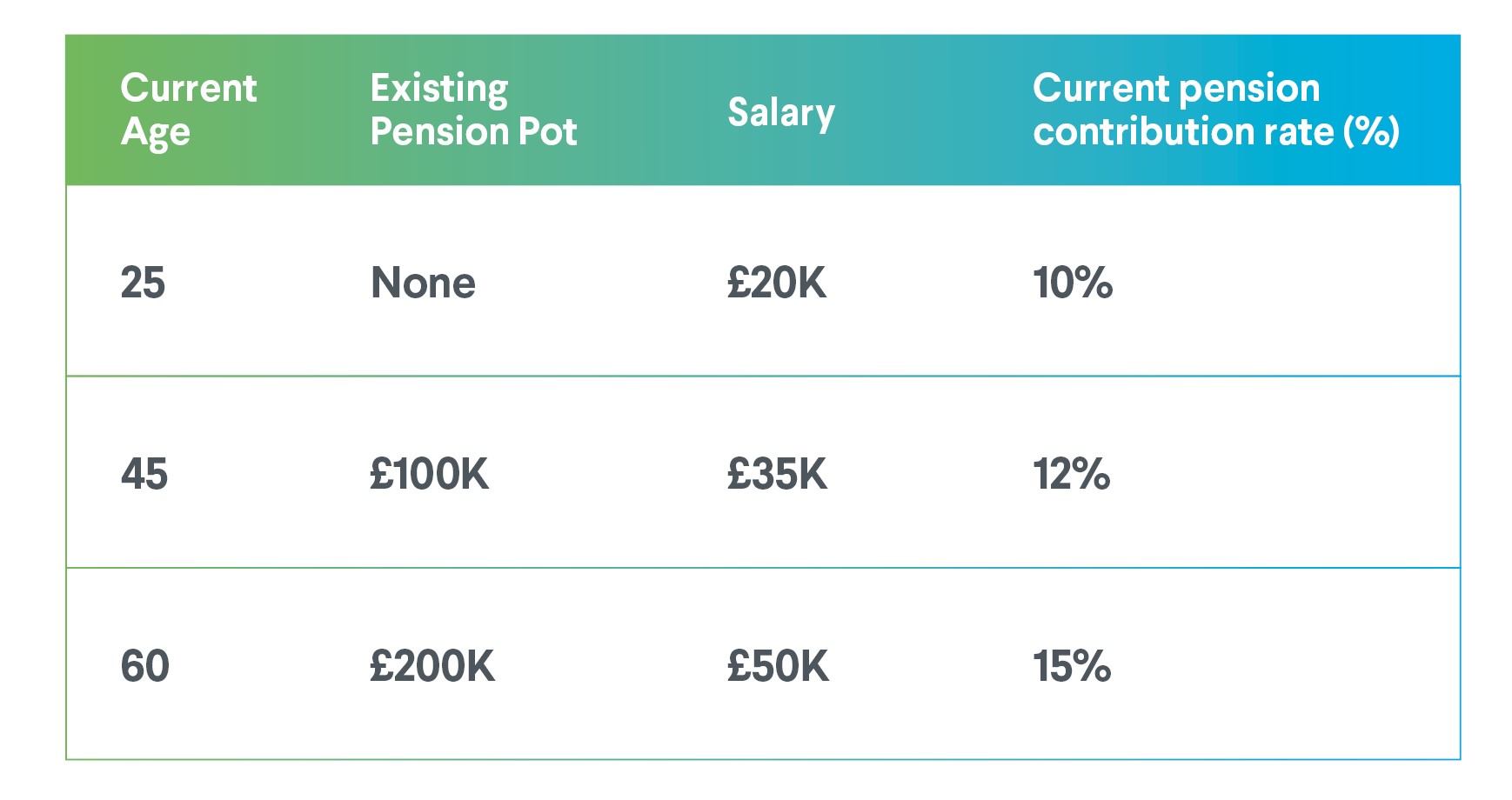

Consider three people saving for their retirement.

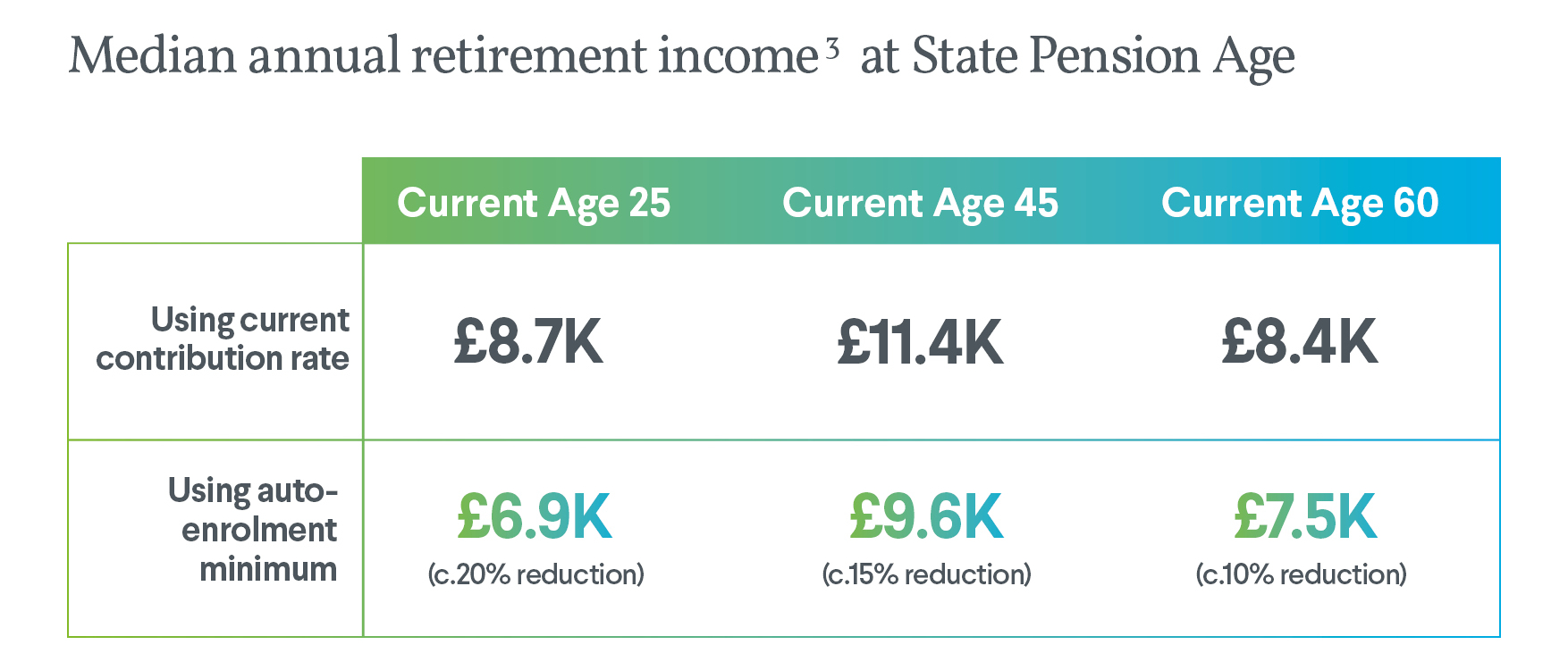

If these savers decided, in order to help them meet rising costs of living in the short-term, to reduce their contribution rates from their current levels, what might this mean for their income in retirement? The effect of reducing total contributions to the auto-enrolment minimum of 8%, and leaving them at this level until retirement is considered in the table below.

As you might expect, a relatively small reduction in pension contributions at a young age can have a very significant impact on the projected retirement income level, owing to the long time period over which this will impact savings. Although many people may increase their pension contributions as they get older, there will be bigger shortfall to make up, if they have reduced their earlier contributions. While a relatively large reduction in contributions later in life will produce a less significant decrease in retirement income, it will still be noticeable as investment returns will have a bigger impact on retirement in later stages once pot sizes are large. This is all made clear by the modelling results shown above.

It’s not all doom and gloom though. Our modelling results shown above assume that reductions in contributions are sustained through to retirement. If instead these reductions were only temporary, and contributions were increased again before retirement, the ultimate reduction in retirement income could be minimised. Further modelling would help savers to understand that, even if they do have to reduce contributions in the short-term, it’s usually not too late to make an impact by increasing them again in the future when that’s affordable.

On the other side of retirement, many of those who are drawing down their pension pots over time are facing similar budgetary pressures. This might lead them to consider increasing their drawdown amounts to meet rising costs of living, whilst not fully understanding the impact this might have on how long their pension pot will last. Digital tools which incorporate ‘what-if’ modelling could help people in this situation to assess the potential impact.

Whether it’s cutting or increasing pension contributions, or increasing withdrawal rates in retirement, most people won’t be aware of the impact that these choices will have on their long-term retirement income. They need access to the modelling power that we’ve discussed above, and this is where digital tools can help people to understand the potential implications of their choices for their retirement prospects. These tools gives people access to modelling results and can empower them with the analyses that they need to make an informed decision about trading off retirement income in the future to meet short-term costs in the present.

At Hymans Robertson we have a whole suite of award-winning APIs and tools which can enable platform providers and advisors to access our modelling capability through Guided Outcomes (“GOTM”). This can then be used to engage effectively with clients, help them to understand their choices and to take appropriate action towards better retirement outcomes.

We’d be delighted to talk to you about our offering of digital tools, so if any of the above has interested you please don’t hesitate to get in touch.

1 ONS Retail Price Index over 12 month period ending December 2021

2 PLSA https://www.plsa.co.uk/press-centre/news/article/cost-of-living-crisis-means-almost-half-say-they-cannot-afford-to-save

3 Projected income is purchased in the form of an RPI-linked individual annuity, using the full final pension pot amount which has been projected using modelling from Hymans Robertson’s Economic Scenario Service

This blog is intended for the use of insurers and reinsurers only. The information contained herein is published only for informational purposes and does not constitute investment advice.

This document has been compiled by Hymans Robertson LLP who reserve all rights to it and is based upon their understanding of legislation and events as at the date of publication. It is designed to be a general information summary and may be subject to change. It is not a definitive analysis of the subject(s) covered or specific to the circumstances of any particular person, scheme, business or organisation. The material and charts included herewith are provided as background information for illustration purposes only. The information contained is not intended to constitute advice, guidance or a recommendation to purchase (or not purchase) products and/or services, or to make (or not make) investments and should therefore not be relied on. This document and any views expressed therein should not be considered a substitute for professional advice in relation to individual objectives and circumstances. Where the subject of this document involves legal issues you may wish to take legal advice.

This blog should not be shared with a third party unless it is appropriate for that audience and acknowledgment of the source is given in a prominent position and (where only part of this document is shared) making the document available in its entirety. Hymans Robertson LLP accepts no liability for errors or omissions, for results obtained from using information or reliance on any statement or opinion contained in this blog, including where this document is provided to a third party (whether with or without the consent of Hymans Robertson LLP ).

This information is not to be interpreted as an offer, solicitation or recommendation to make (or not make) any specific investments or product decisions. All forecasts are based on reasonable belief. Please note the value of investments, and income from them, may fall as well as rise. You should not make any assumptions about the future performance of any investments or products based on information contained in this blog. This includes but is not limited to equities, government or corporate bonds, currency, derivatives, property and other alternative investments, whether held directly or in a pooled or collective investment vehicle. Further, investments in developing or emerging markets may be more volatile and less marketable than in mature markets. Exchange rates may also affect the value of an investment. As a result, an investor may not get back the full amount originally invested. Past performance is not necessarily a guide to future performance.

0 comments on this post