Housing costs halve chances of reaching the Minimum retirement income level

Spokesperson

People who pay rent in retirement have a substantially lower likelihood of achieving the Minimum standard of living in retirement, as measured by the latest Pensions and Lifetime Savings Association’s (PLSA’s) Retirement Living Standards (RLS), according to analysis by Hymans Robertson. The firm used its Guided Outcomes (GO)TM Modelling technology to calculate the chance of various members achieving different levels of retirement income under the PLSA’s recently revised RLS. By considering factors including someone’s age, salary and pension contribution rate, the consultancy found that paying rent in retirement halves someone’s chances of achieving the Minimum standard. The leading pensions and financial services consultancy claims that the industry and government need to think creatively about how saving for retirement could include getting on the property ladder, and removing the need for housing costs in later life.

The levels of retirement income set out by the PLSA correspond to different RLS. These are Minimum (£13,400), Moderate (£31,700), and Comfortable (£43,900). The Minimum standard of living in retirement has previously been considered highly achievable – and the recent update to the RLS in June brought it within reach of many more members, as it’s now not much more than the state pension.

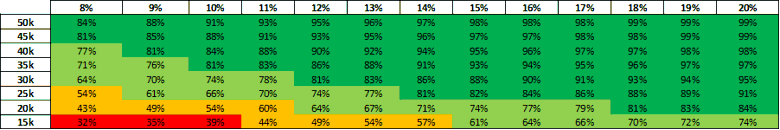

The standards do, however, allow for paying housing costs in retirement, and Hymans Robertson’s analysis showed that allowing for housing costs makes a fundamental difference to the likelihood of whether someone will reach this Minimum standard or not. If people were helped to purchase a property while saving for retirement, using pensions savings as collateral, then this could help reduce the rent burden in retirement. An individual earning £20,000 with a joint employee plus employer pension contribution of 8% is almost certain (with a 98% chance) to achieve the Minimum standard in terms of their income. However, if the cost of housing, which at this age is likely to be rent, is taken out of this retirement income the chance of reaching the Minimum standard falls dramatically and they only have a 43% chance of reaching it.

Commenting on the findings of the analysis, Hannah English, Head of DC Corporate Consulting, Hymans Robertson, says:

“Our analysis spells out how big a difference paying for housing makes in dictating an individual’s quality of life in retirement. To drop from an almost guaranteed (98%) chance to a 43% likelihood of achieving the Minimum standard is a huge drop that should not be understated.

“The other major finding from our research is that the current 8% minimum under auto-enrolment (AE) is unlikely to provide average earners with either Comfortable or Moderate standards of living in retirement. As outlined in our recent pensions policy paper, The Untapped Potential of Pensions, we believe an increase of contribution level to 12% must be put in place if the chances of a better retirement are to be achieved. We also set out that AE should be extended to all workers, not just those earning over £10,000. Both of these changes will help workers achieve better standards of living in retirement and, in tandem, help to close the pensions gender gap, benefitting over one million female workers.”

Commenting on how housing needs to be addressed when assessing adequacy in retirement, English adds:

“One way to improve the adequacy of living standards in retirement, and also to reduce the number of those renting in retirement, is to allow pension savings to be used as collateral for mortgages – for first-time buyers only. This arrangement would let people get on the housing ladder without a deposit, and benefit from lower interest rates as lenders take on less risk of negative equity. Crucially, the money in the pension would still be invested – just in property, rather than in bonds or equities. Alongside the investment, the likelihood of someone being ladened with paying rent throughout retirement is reduced as they could have paid off their mortgage by the time they reach retirement.

“What our proposal does not fix is a lack of affordable housing. For our idea to work most effectively, there needs to be more social housing available for people to buy. It’s for this reason that we welcomed the government’s £39bn commitment to social and affordable housing over the next ten years in the recent Spending Review. We hope this will move the dial in fixing the supply-side problem of getting more people on the housing ladder, as it would significantly improve their chances of reaching the PLSA’s Minimum standard of living in retirement.

“The government has a crucial role to play in making a desirable retirement achievable. This government has engaged with the industry and hit the ground running with their focus on pensions, as seen in the recent Pension Schemes Bill and Pensions Investment Review. But as these numbers show, there are still near-endemic issues in the UK regarding people reaching a desirable standard of living, or even being able to afford to retire. Our proposals would help improve the standard of living for the UK workforce after they punch their timecard for the final time.”

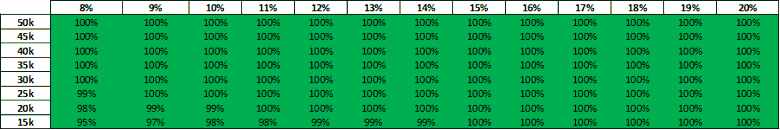

The firm calculated future retirement incomes by considering member specific characteristics such as age, salary, assumed investment choice and retirement age. The percentages in the table below are projections based on the firm’s Guided Outcomes (GO)TM Model. The results are categorised using a colour scale of red (unlikely to achieve the standard), amber (moderate likelihood), and green (likely to achieve the standard). The percentages across the top (x-axis) of the table are joint employer plus employee pension contributions, and the y-axis displays an individual’s annual salary. The difference in colours between the tables demonstrates the large impact that housing has on someone’s likelihood to achieve the Minimum standard.

Minimum Retirement Living Standard (without housing costs)

Minimum RLS (with housing costs)

Important information

This communication is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this page refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.