The regulatory focus on illiquid unrated assets has continued with the update to SS3/17 (Solvency II: Illiquid Unrated Assets) published in November 2024. Over the past year, adhering to the requirements outlined in the supervisory statement has been a key priority for Bulk Purchase Annuity (BPA) providers, as well as for our team. The requirements cover a broad range of activities, including ratings tools and scorecards, team capabilities and experience, internal and external validation, and governance processes. In this blog, we discuss approaches for assigning and validating internal credit ratings (ICR) taken across the industry.

The need for internal credit ratings

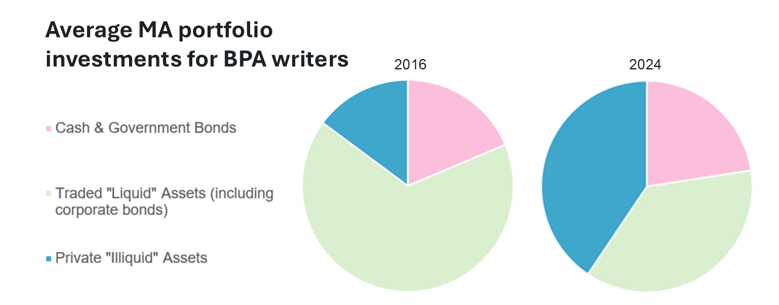

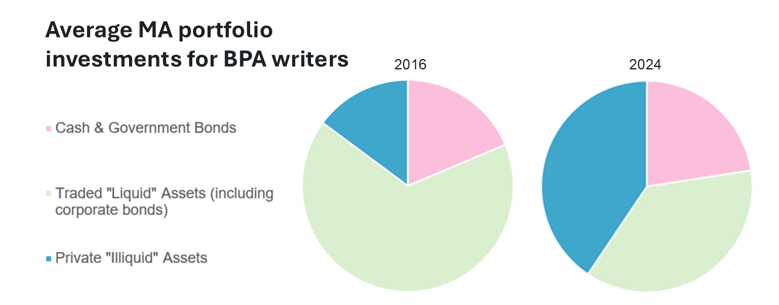

Illiquid assets, such as equity release mortgages, commercial real estate loans and private placements, now make up over a third of BPA writers’ Matching Adjustment (MA) portfolios, more than double the level observed in 2016:

*Source: Hymans Robertson annual MA surveys

To support MA calculations and risk management, insurers must assign credit ratings to unrated assets. While external credit rating agencies (CRAs) are still used, ICRs have become more common as firms expand the scale and breadth of their illiquid holdings.

The PRA’s expectations

Within SS3/17, the Prudential Regulation Authority (PRA) sets out its expectations for ICRs, and firms are needing to:

- Ensure ICR outcomes lie within the plausible range of ratings that a CRA might assign.

- Be able to demonstrate how ratings assessments achieve ‘broad consistency and no bias' within this plausible range (at both an asset class level and a portfolio level).

- Ensure credit rating functions have sufficient resources, experience, expertise and independence to develop methodologies and undertake assessments.

- Have robust validation frameworks which clearly explain how credit ratings are checked, the frequency of checks, how many assets are reviewed, and what level of difference is acceptable between ratings.

- Obtain external assurance that is proportionate to the risk of their ICR output.

- Oversee outsourced or externally managed credit rating processes (eg, via external fund managers) effectively.

Our survey says…

We surveyed BPA writers to understand how they approach ICRs. The survey considered topics such as the proportion of illiquid assets that are internally rated, reliance on provision of ratings from external asset managers, and the approaches taken by BPA writers to validate their internally rated assets. We describe some of our observations from the results of the survey and follow-up discussions below:

Not all validations are the same:

All respondents perform internal validation, but the depth and methods employed differ. Whilst we would expect differences due to the size and complexity of holdings, even comparable firms had different expectations of what constituted robust validation:

- Some use light-touch reviews (eg, sense-checks).

- Others conduct deep dives into data, assumptions, expert judgements and rating overlays.

- Hybrid approaches included lighter reviews for “standard” assets, and deeper reviews for complex or new ones.

- Shadow ratings are used by several firms to benchmark internal assessments.

Validation of methodologies also differed. Some use structured scorecards (eg, assessing risk coverage, reliance on expert judgement and alignment to CRA methodologies), whilst others rely on more subjective assessments of methodological appropriateness.

Not all governance is the same:

For example,

- Some committees are investment-led (1st line), others are risk-led (2nd line).

- The level of detail in committee papers, such as assumption justification, use and results of expert judgement, and documentation of challenges, varies significantly.

These differences may affect how easily firms can demonstrate compliance with PRA expectations.

Oversight of external asset managers is not the same:

BPA writers use external asset managers to varying degrees. Oversight approaches for external asset managers include:

- Some BPA writers apply similar oversight to rating assessments provided by external asset managers as they do to internal credit ratings, including second-line validation of credit methodologies and external assurance of sample ratings by a CRA.

- Some firms’ validation approaches were less involved, with the credit rating committees opining on a credit rating paper.

- A number of BPA writers placed more reliance on the external asset managers’ systems and governance processes.

SS3/17 makes it clear that insurers must be able to demonstrate the effectiveness of the credit rating systems, capabilities and governance of external asset managers, and show that those assessments comply with regulatory requirements, including lying within the plausible range. As such, where relied upon, insurers must be able to evidence that external asset managers have robust credit rating functions with appropriate validation and governance systems in place.

Independent external assurance

Whilst SS3/17 suggests that having sample assets assessed by a CRA will help demonstrate broad consistency between an insurer's credit rating assessments and a CRA’s issuer ratings, the regulatory guidelines fall short of mandating the use of CRAs in the validation.

The cost of obtaining a rating from a CRA can range anywhere from tens to hundreds of thousands of pounds, potentially making validation exercises a costly endeavour. Cheaper alternatives might include obtaining a ‘credit opinion’ or ‘rating estimate’. These are usually broader, non-committal opinions from a rating agency that provides an assessment of the range of possible credit rating outcomes. Whilst these credit opinions are helpful, they are not as rigorous as CRA rating assessments, often providing only high level analysis (which may cause difficulties when using them to formally validate internal credit rating outcomes).

Consequently, insurers are increasingly looking for independent assurance on the entire end-to-end ratings process (eg, on the internal rating methodologies, rating scorecards and inputs) to further demonstrate that their internal credit ratings approach achieves broad consistency with the range of plausible ratings from a CRA.

How can we help

We've supported insurers and asset managers in several areas of credit ratings, including the development and review of internal credit rating methodologies, the evaluation of frameworks and policies, and the assessment of internal rating capabilities and governance structures. we've also supported our clients to address PRA challenges, as internal credit ratings continue to be an area of focus for the regulator.

For more information, please reach out to your usual Hymans Robertson contacts or get in touch here.

This blog is based upon our understanding of events as at the date of publication. it is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use.