During October 2019, the Pensions and Lifetime Savings Association (PLSA) launched its Retirement Living Standards (RLS) to help individuals understand the level of income they will need in retirement and the lifestyles that different levels of income will allow them to have.

The PLSA announced three expenditure levels, representing Minimum, Moderate and Comfortable standards of living in retirement, which can be approximated by the rules of thumb shown in the chart; £10k, £20k and £30k for singles and 1.5 times those figures for couples.

At Hymans Robertson, we set target incomes for members of DC schemes as part of our Guided Outcomes (GOTM) technology, so we are fully supportive of the RLS and have agreed to be early adopters. We believe that setting targets is a crucial step in helping members engage with their pension; too many people simply don’t know what level of income they will need when they retire and how much they need to save to achieve it.

Saving enough to meet the Standards

So how much might a typical employee need to save to meet the RLS?

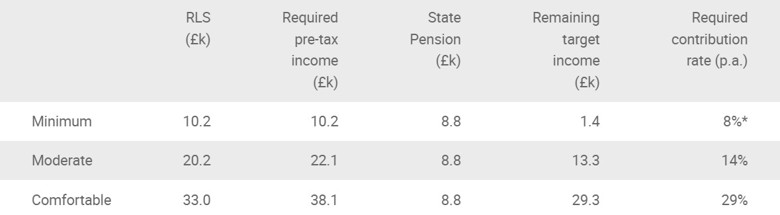

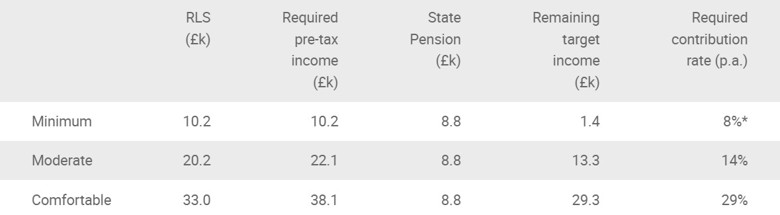

Consider a 25-year-old earning £30.4k p.a. (i.e. median gross earnings for UK full-time employees, as at April 2019) and planning to retire at their State Pension Age (SPA), which is currently 68.

The following table shows the annual (total) contribution rates our GO modelling indicates are required to give a good chance (defined as at least 60%) of achieving the RLS.

*8% is the current minimum total contribution rate under auto-enrolment legislation

- Our modelling shows that the State Pension plus AE minimum contributions gives a good chance of achieving the Minimum RLS.

- An average earner will need total contributions of 14% p.a. to have a good chance of achieving the Moderate RLS and more than double those contributions to have a good chance of achieving the Comfortable RLS.

Maintaining engagement

Our experiences with GO have shown us that setting targets is an effective way of encouraging members to take the first steps toward managing their pension. However, pension saving is a long-term commitment and it is important that individuals continue to engage with their pension throughout their savings journey.

The level of pension you might receive in future and how much you need to pay to reach a target can be estimated but cannot be known for certain. Unfortunately, unexpected changes in markets and other factors can impact the chance of achieving your target and changes to contributions and/or retirement age may be required to get back “on-track”.

Furthermore, changes in personal circumstances such as new additions to the family or new working patterns can mean that targets (and what is required to achieve them) need to be re-evaluated.

We recommend that individuals review their pension at least once per year so GO users receive an annual statement, which shows their position against a target and directs them to consider actions such as changing their contributions or retirement age, where this might be appropriate.

This approach combines 3 principles, which we believe should form the benchmark for promoting member engagement in DC:

- Setting targets – show members what income they’ll need when they retire.

- Clear communication - help members understand what their savings could provide.

- Member action – prompt members to act to improve outcomes.

This model has been effective for us in helping clients improve member engagement and we are confident that the introduction of the RLS will help us continue that improvement.

Listen to our podcast

In episode 1 of Hymans Robertson On... Mike Ambery, Head of DC Provider Solutions and Paul Waters, a partner in our DC consulting team chat about the recent launch of the PLSA’s retirement living standards.