Regulatory updates, including the new DB Funding Code and the upcoming Pensions Bill, twinned with market volatility, mean now is a great time to take stock of what it all means for you and your scheme.

In this blog, we recap five key themes and takeaways from our recent webinar with The Pensions Regulator (TPR) which you can watch on-demand here.

Bespoke or Fast Track for funding?

Take the approach that’s best for your scheme and don’t be afraid to use the bespoke route.

TPR expect 80% of schemes could achieve fast track parameters leading to some feeling that bespoke isn’t as good as fast track or will lead to automatic scrutiny from TPR.

TPR confirmed they won’t engage with all schemes taking the bespoke route and they will continue to engage with those where they have the greatest concerns. For example, if a scheme meets all-but-one fast track parameter and has a good reason for why they deviate from fast track on that parameter, it’s unlikely that TPR would engage.

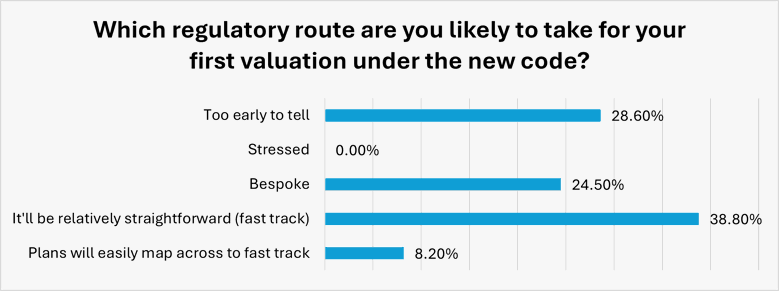

When asking participants which regulatory route they were likely to take for their first valuation under the new code, our webinar poll showed more choosing fast track than bespoke but with many still too early to tell.

Schemes are encouraged to do what they believe is best for them, their strategy and their circumstances. Don’t automatically pick fast track because you pass – set your strategy first and let compliance with the funding code follow (rather than vice versa). Time will tell how many schemes use fast track and bespoke, as the 29% work through the details and choose a path.

Managing market volatility

Schemes should review their investment strategy and governance in light of market volatility to ensure they’re well placed to withstand continued volatility.

Schemes have generally managed well during the recent bout of market volatility. The sell off was triggered by Donald Trump’s ‘Liberation Day’ tariff announcements - these were soon paused in large part leading to a swift market recovery. However, schemes shouldn’t become complacent as there’s still a lot of uncertainty and potential headwinds for markets. Market events can blow schemes off course – particularly those with shorter time horizons.

As well as managing collateral and liquidity to deal with short term volatility, schemes are encouraged to continuously test their current strategy against their longer-term objectives to ensure the level of risk they’re taking is consistent with these longer-term objectives.

TPR noted drivers of market volatility can also drive covenant reliability (especially in certain sectors) and stressed the need to monitor covenant alongside checking collateral and liquidity.

TPR have recently confirmed they’re stepping up their focus on investments. This was emphasised in our webinar, noting they’ve grown their team as well as working more closely with the Financial Conduct Authority (FCA) and Bank of England. This allows them to have a much closer view of the economy and can build this into their regulatory approaches and how they engage with schemes.

Endgame – which path to take?

Schemes are encouraged to consider options and plan for their endgame, whilst keeping this under review should alternative endgame opportunities arise.

Options for endgame are evolving at pace, with more choice now than a year ago for those who don’t want to go straight to buy-out.

- TPR noted endgame isn’t a binary choice, but a fluid process. For example, a scheme may choose to run on before choosing to buy out or move into a superfund.

Surplus

There’s generally support on having more guidance and flexibility to release surplus but concerns remain on the risk to trustees, sponsors and members.

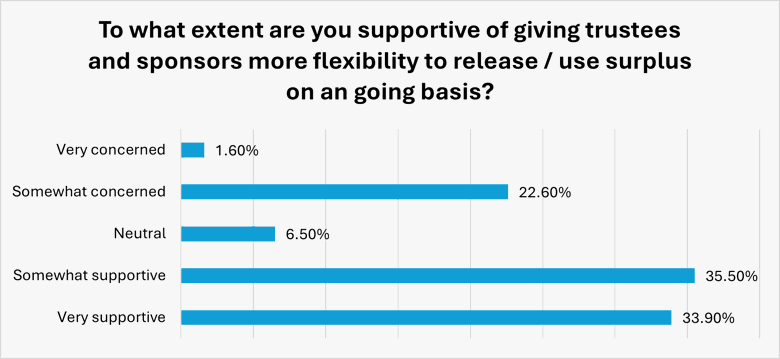

When asking participants to what extent they were supportive of giving trustees and sponsors more flexibility to release / use surplus on an ongoing basis, our webinar poll showed that there is generally support for this although concerns remain.

Concerns included the risk to the trustees if surplus was shared and the scheme subsequently required support. There was also concern over the shift in thought process away from protecting accrued rights required when deciding whether to share surplus.

It was noted the former could be managed through regular monitoring and contingency plans, enabling schemes to act quickly as well as only sharing surplus above full buy-out funding. Furthermore, for a well-funded and well-governed scheme, documenting the reasons for decisions alongside the advice taken should be second nature, and TPR noted they would expect a similar approach to decisions in relation to surplus sharing.

The industry awaits further detail on surplus sharing expected in the widely anticipated Pension Bill.

Early collaboration will help inform proportionality

Approach your valuation collaboratively with all stakeholders. Start discussions early and consider what proportionate means for you.

Previous valuation processes may have been linear but there’s an expectation that the funding code will encourage a more iterative process with more regular touchpoints. The change in approach will mean it will be worthwhile starting early.

Trustees will need input from actuarial, covenant and investment advisers as well as wanting engagement from sponsors on strategy and long-term objectives. This requires a collaborative approach.

This change in approach and understanding early where your scheme is on the various fast track parameters will help inform proportionality for your scheme.

If you’d like to discuss anything further, we’d love to hear from you. Please get in touch.

This blog is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.