When the Pension Protection Fund (PPF) was set up in 2005, 35% of private sector Defined Benefit (DB) schemes were open to new members. A further 50% were open to new accrual but closed to new members, and 3.6 million people working in the private sector were building a DB pension.

Private sector DB schemes held total assets of £770bn invested broadly 60% in equities, 30% in bonds and 10% in other investments, like property and cash, with a notably small amount (less than 1%) in insurance policies. The cost of accrual for a 1/60th 'steady state', open DB scheme with a 65% equity/35% bonds allocation was around 15% of salaries (gross of member contributions), assuming a reasonably prudent long-term investment return of 6.7%, or gilts plus 2%.

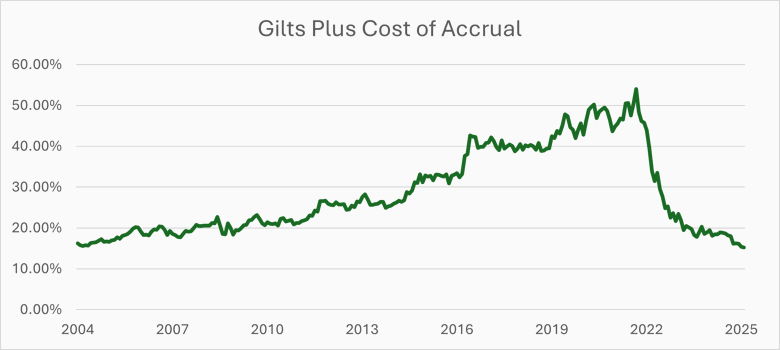

Over the last 20 years, gilt yields have been volatile – falling from around 5% to below 1% after the global financial crisis but rising in the last three years to their 2005 levels. As a result, the gilt-based cost of accrual has ranged widely, starting at around 15%, increasing to over 50% in 2021 and dropping sharply to around 15% in late 2023.²

Private sector DB schemes now hold £1.2 billion of assets and have largely de-risked, investing around 70% in bonds, 15% in equities, 10% in insurance policies and 5% in other investments. An interesting fact is that if we allow for equity returns since 2005, that change in asset allocation represents a 90% sell-off of the equities held by DB schemes 20 years ago.

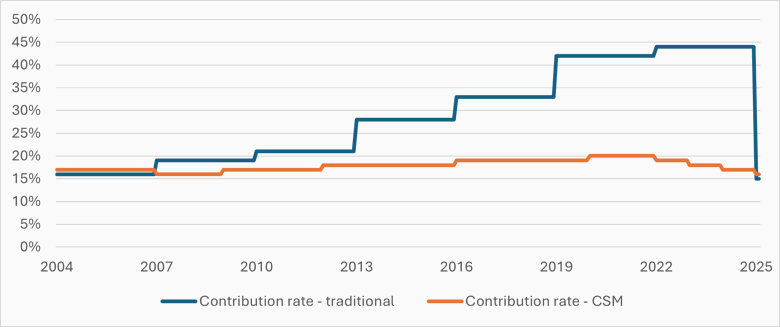

Around 15 years ago, in response to faling gilt yields, we developed a Contribution Stability Mechanism (CSM), which Local Government Pension Scheme (LGPS) clients used to avoid the steep increase in pension costs seen in the private sector. Rather than use a simple gilts-plus approach with current market conditions, our CSM approach uses stochastic modelling to look at the probability of paying pensions in the long term. By combining past and future service, white taking a long-term approach to setting contribution rates, we were able to cut through short-term funding volatility to deliver stable and affordable contributions, with annual changes in contribution rates restricted to a predefined maximum.

The graph below compares contribution rates under our CSM approach with those under a traditional gilts plus approach for our example scheme.⁴ This scheme tests it’s CSM annually basis. Stochastic modelling is used to calculate a probability of being able to pay pensions in the long term on a low-risk basis, and the scheme benchmarks a probability of greater than 70% as success.

The operation of this CSM is very simple: if the probability of success falls below 65%, then contributions increase by 1%. It increases to above 75%, contributions decrease by 1%. The impact is striking, as shown in the graph. By taking a long-term approach and limiting changes (both upwards and downwards), volatility in contributions is almost entirely avoided while maintaining the security of members' benefits.

Source: Hymans Robertson

It's also worth noting that implementing a CSM in 2004 would have saved the sponsor over £90m in contributions over this period (that’s twice their annual 2024 payroll!). The scheme would still be in a very strong position at 31 March 2025: 120% funded on a gilts plus 2% basis at 31 March 2025.

So, can this be applied in the private sector?

Yes, and we’re already doing this.

Scottish Enterprise used our CSM to maintain a stable 20% contribution rate all the way through the low yield environment, even at the low point of index linked gilt yields in 2021.

The new code provides much more flexibility for open schemes and supports a CSM approach, which would be documented in the scheme’s statement of strategy. It can also be combined with a gilts-plus funding basis (with a dynamic plus) for trustees who don’t want to move too far away from a traditional approach, and for regulatory reporting.

Conclusion

With traditional gilts-plus contribution rates as low as they have been for over two decades, it could be worth considering using a CSM for your open scheme for the following reasons:

If you want to find out more about how a CSM could work for your scheme, please contact our open schemes team for a no- obligation discussion.

1 The Purple Book, 2006

2 Cost of accrual on a gilts plus 2% basis, assuming an average age 50, retirement age of 65 and an accrual rate of 1/60

3 The Purple Book, 2024

4 We have modelled a ‘steady state’ NRA 65 scheme with an average age for active members of 50, average salaries of £22,000 in 2004 and 1,000 active members. This scheme invests 65% of their assets in equities and 35% into bonds (70% gilts and 30% corporate bonds).

This blog is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.