In January 2023, the UN-convened Net-Zero Insurance Alliance (NZIA) released their Target-Setting Protocol (“Protocol”). With significant implications for the reporting requirements of financial institutions, we discuss what this means for general insurers and reinsurance companies.

A statement of intent from the industry

18 months since the formation of the NZIA, the first Protocol to systematically record, report and target reduction of Green-house Gas (“GHG”) emissions for insurers has been published. This will require insurers to quantify, map and thereby focus on reducing their GHG emissions exposure in their underwriting portfolios.

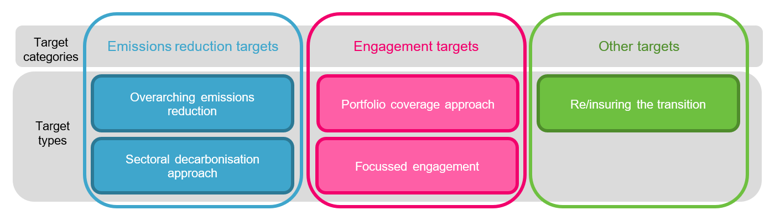

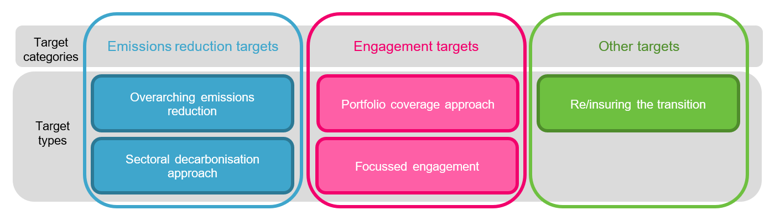

The Protocol sets out five emission target types across three target categories. Existing NZIA members will be required to set at least one of the five target types (shown below) by 31 July 2023, and at least one target type in each of the three target categories by 31 July 2024. Those joining NZIA after January 2023 will have six months to set their first target and then a further year to set a target type in each of the three target categories. Each target requires a timeline to be set and progress to be reported against the target.

More detail on each of the above target categories and target types can be found in the Protocol

Challenges on the horizon

A number of business lines remain exempt from reporting and the data availability varies significantly between insurers and business lines. While calculations are relatively simple, where the data is available, aggregating it into the required format may be challenging.

The NZIA seeks to achieve its reduction in GHG emissions on an overall basis, with some participants expected to meet their targets faster than others. However, how equity is achieved in allocating who must progress towards their targets faster and who may progress slower will be interesting to observe. We might expect smaller companies to find implementation harder if they have more limited resources.

Publishing targets will bring valuable accountability and will allow for comparison between companies. There may be competitive advantages in being seen to be ahead of the pack and there could be adverse reaction if the targets are not seen as challenging enough or where such published targets are not met. Businesses will need to carefully consider the approach they take.

Overall, this Protocol represents a serious attempt by insurers to support the international effort to reduce GHG emissions. Insurers now need to consider what the Protocol means for them and how to implement its recommendations.

Looking forward and actions for insurers

Insurers should understand which of their business lines are in scope and what data they already have available, what will be easy to obtain and what will be more challenging. Insurers should also consider what decarbonisation levers are available for their portfolios. This will enable realistic targets and timeframes to be set. Adherence to the Protocol should be included as part of the broader emissions targets of the business.

The Protocol recognises further work is required, with the next version planned for release 31 December 2023 and consultation expected before publication. This promises to address target validation, scope expansion (including incorporating lines of business not currently in scope), refinement of the target types and portfolio target boundaries. Insurers should also keep an eye out for any upcoming consultations.