Many insurers and pension schemes have gone through the process of running climate-related scenarios and reporting results to their boards and trustees. One relatively common response to these initial results is “so what?”.

Decision makers are observing that climate scenario modelling results do not look very severe, leaving the impression that climate change isn’t a particularly material risk. This is surprising given climate change is among the most important challenges facing humanity today.

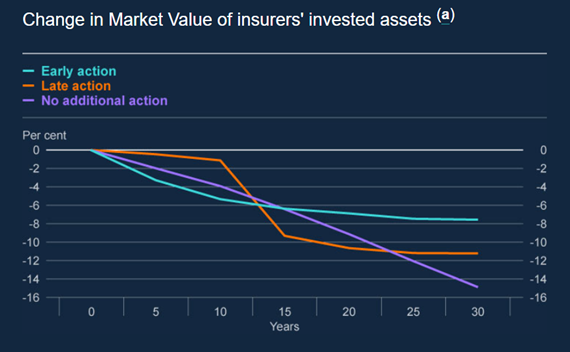

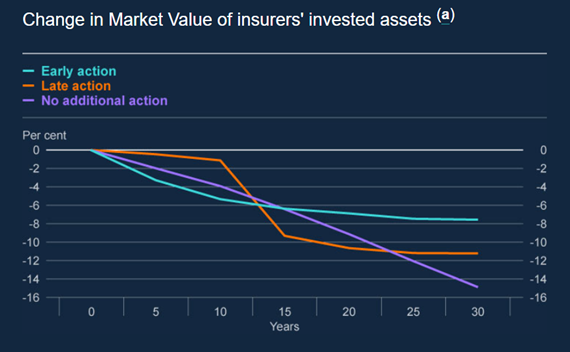

The below chart comes from the results of the Climate Biennial Exploratory Scenarios (CBES) run by the Bank of England. It shows how insurance assets are affected in three scenarios (“Early action”, “Late action”, “No additional action”) over the next 30 years.

Source: Chart 4.7 from CBES results

For insurance asset values, the worst impact was for the No Additional Action scenario, a scenario in which humanity does little to contain the harms done by climate change. This scenario indicated a c15% decline in market value of assets over a 30-year time horizon, which is c0.5% per year.

This situation has echoes in the pensions space with early TCFD disclosures similarly suggesting that the impact of climate change is not dramatic. Further, it is common for climate related scenarios to show little difference in impact between scenarios with more physical risk and scenarios with more transition risk.

One reason why outcomes are so underwhelming is that models are calibrated to historic data and omit the biggest forward-looking risks.

Much of the climate scenario modelling that occurs today, certainly among insurers, and also to a large extent among pension schemes, is heavily influenced by the Network for Greening the Financial System (NGFS). NGFS is a collection of regulators and central banks which came together to coordinate with regards to climate change and how it interacts with the financial system. They have also provided some specifications of climate scenarios, which have formed the basis for climate scenarios used by regulators and others.

Ultimately, most climate scenario models, and certainly those based on the work of NGFS, are rooted in well-established climate models known to academia. Whilst it’s understandable that NGFS would choose to lean on well-established models, a feature (or, some might say, a bug) of these climate models is that they are based on historic data.

-

Damages for which we have data, such as “heat stress” (people are typically less productive when they’re hot, so GDP goes down in higher temperatures), typically are captured in standard climate models.

-

Damages which have occurred infrequently or not at all before, such as climate-related pandemics or wars typically are not explicitly captured in standard climate models.

NGFS are explicit about this shortcoming in their models. They said in their 2021 technical specification document that “these effects capture productivity impacts (labour and land productivity, capital depreciation) related to changes in annual temperature. Therefore, non-market effects as well as effects from extreme events, sea-level rise or indirectly related societal dynamics like migration or conflicts are not included in those estimates”.

Further, in a joint statement with the Financial Standards Board, NGFS pointed out that scenario analysis derived from NGFS scenarios may understate climate exposures and vulnerabilities.

What’s more important, what’s in the model, or what isn’t?

The harms omitted from these models, sometimes referred to as cascading climate events, climate tail risks, or green swan events, collectively have the potential to be material. The question of how material these factors may be compared to the modelled risks is yet to be examined in any detail.

It’s possible that tail risks could be severe enough that they are the dominant consideration, even if they are less likely to arise. If this is the case, it suggests there may be an opportunity for pension schemes and insurers to explore new angles with their climate scenario modelling. We will explore this in further blogs.