One year on from the launch of Investment Pathways we are seeing a mixed bag of investment performance and customer engagement with the initiative across the industry. However, whilst Investment Pathways has been much maligned in some quarters, the concept is sound and it remains a welcome and important development for UK retirees going forward.

What is Investment Pathways?

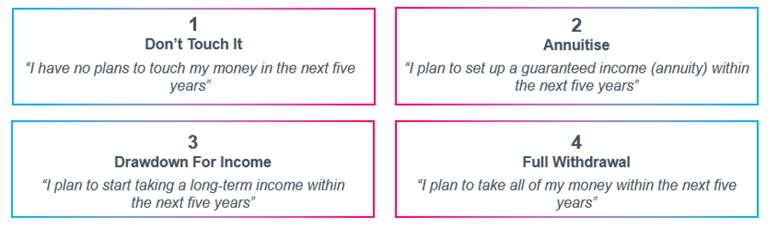

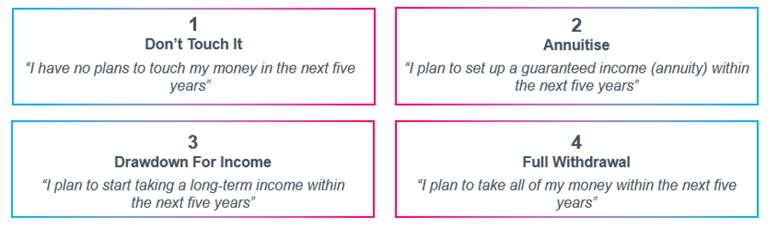

Introduced in February 2021 by the Financial Conduct Authority (FCA), the Investment Pathways initiative requires pension providers to offer customers the choice of four investment solutions each designed to meet a high-level retirement objective over the next five years:

Without financial advice, consumers were often found to take the tax-free cash from their pot and leave the remainder sat in cash as a result of not making an active decision about it, missing out on the benefits of longer-term investing. The introduction of Investment Pathways allows these savers to identify their objectives with one of the four pathways and have access to an investment solution designed to meet that objective.

Despite this wide appeal, Investment Pathways is clearly not for everyone. Engaged investors or those with large pots for whom advice is more easily accessible and affordable are unlikely to find them useful. This is highlighted in the reported usage across the provider market, with different providers reporting a range from just 0.6% of savers engaging with Investment Pathways to over 90% engaging.

Some providers may be experiencing low usage because they typically attract more engaged investors or those with larger pots and thus more likely to take financial advice. We would not expect these providers to have a high level of Pathways usage. However, others may find this low usage is due to ineffective communications and signposting about Investment Pathways.

Communications, tooling and engagement

Across the industry we see very different approaches to developing communications and increasing customer engagement with the initiative. Many firms are offering basic, generic communications making it harder for customers to understand the Pathways and engage.

More progressive firms are providing personalised communication and tools for their customers which build on the Pathways retirement objectives, and communicate potential outcomes for the customer. In the case of the drawdown pathway, where the customer has control over their rate of withdrawal, these tools are vital to allow customers to understand how much money they can take out and for how long.

By clearly integrating tools into the decision-making journey, these providers are enabling customers to better understand their retirement options and to develop a personalised retirement plan. Providers can differentiate themselves with strong communications and accessible personalised tooling for Investment Pathways. This will help to attract more customers and ensure that those who would use Pathways will maximise their benefits from it.

Investment allocations

Reviewing the market shows a wide variety of investment solutions proposed by different providers for each pathway. For example, for the full withdrawal pathway (Pathway 4), one firm has proposed an investment solution invested 25% in equities and more than 60% in bonds, whereas another has proposed an allocation almost entirely to cash. Firms have generally done a good job of making the investment risks known to their customers. However, with such a wide variation in asset allocation for a single five-year retirement objective, even before considering the impact of fund selection, we will see significantly divergent performance over time. There will be no hiding place for the providers who lag the performance table.

Looking towards the future

There is an added complication for savers. Trust-based providers are not yet required to offer retirement solutions based on Investment Pathways. Someone reaching retirement with a personal pension and a trust based pension will find a confusing lack of consistency over the way their retirement options are presented to them. This must be addressed in order to help savers at retirement.

Whilst Investment Pathways has its issues, they are solvable. We hope that firms continue to develop their Investment Pathways solutions through clearer signposting; well-considered asset allocations; and much more personalised digital engagement tooling for customers. The more we can inform and guide those entering retirement, the better the expected investment outcomes for unadvised customers.

If you'd like to discuss anything further, please get in touch.