There is growing concern among activist groups and across the public that companies will not react quickly enough to mitigate the effects of climate change and reach the agreed targets of the Paris agreement. As regulation and general cultural trends head more towards a net-zero world, this raises the question of why some companies and investors may be slower to react than others. In this blog, we focus on some of the underpinning psychology for this and how we can use this knowledge to identify biases in facilitating the journey to net-zero.

Cognitive bias is a systematic error in thinking. The human brain has a predisposition to perceive information through a filter of personal experience and preferences and therefore ‘rational’ decisions may be overlooked in favour of more familiar or automatic thinking. When taken in the context of climate change this means that an individual may not perceive the true risks of climate change and therefore what is required to mitigate them.

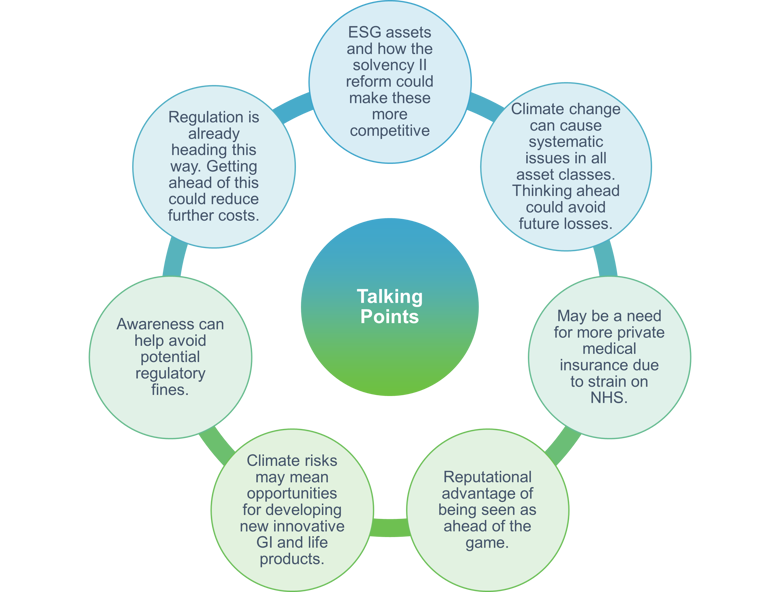

While informative, this definition doesn’t initially help us to tackle the problem as it is not cost effective to attempt personalised education on a societal scale. Therefore, it is useful instead to understand and teach how human psychology influences decision-making on an unconscious level to empower individuals in observing and mitigating their inherent biases, as well as helping others to do the same. The figure below gives some examples of biased thinking; the interaction of these psychological mechanisms creating the overall phenomenon of cognitive bias.

Short-term thinking plays an element here as well. People tend to only consider short, more conceivable timeframes and immediate issues, which can lead to struggles in planning for the longer term. This often means that solutions can be overlooked or delayed as quicker, but less effective, measures are used instead. While these temporary solutions may appeal, they can often have longer term impacts and delay the real fixes. This is a major concern with climate change as a compounding, multi-faceted problem.

As solutions to climate change and the risks associated with it are often long-term in nature, short-term thinking struggles to address either sufficiently. This combined with individuals’ underlying biases on climate change, its impacts, and the timeframe to react makes this a complex issue to unravel. Our actuarial work may be focused on analysing and interpreting underlying data, navigating potential biased thinking, and using this to monitor and manage risks. However, it also requires an understanding of human psychology to support real change.

Biased thinking can be difficult to avoid, but taking the time to acknowledge and analyse these thought processes gives us the opportunity to challenge them, find alternative solutions and more adequately cover the risks involved. To support this (and diversify ideas) alternative views and opinions should be sought out where possible.

Open communication and sharing of knowledge and ideas between firms is also going to play a large part in targeting climate change risks and meeting regulatory requirements across the industry. Open and transparent discussions in this area are key to ensuring information is spread quickly, allowing ideas and solutions to develop and a unified approach to be reached.

Individuals often want to avoid the issue of climate change as it can seem too negative of a topic with no actionable solutions. Therefore, being aware of these initial biases and finding a positive spin or attractive viewpoint will help to start these conversations off on the right foot. By approaching the topic as something to find opportunity in, rather than something that needs to be fixed, you may gain a better understanding of the leverage you have in generating impact.

At Hymans Robertson we make a conscious effort to identify and tackle our own biases as well as helping our clients do likewise – hosting internal presentations on the impacts of bias allowing our teams to be more aware of their own thought processes when tackling problems. Maintaining awareness of potential bias and continuously working to challenge them allows us to provide our clients with fully thought-out solutions free from our individual preference or influence. We have also provided similar training to clients, enabling them to challenge their own biases and embrace cognitive diversity and its potential.

The aim here isn’t to use psychology to change the minds of our clients to our way of thinking but instead to give them the chance to consider and take note of other options that may otherwise have passed them by. We acknowledge that care should be taken when having these conversations to make sure that biases are not influencing the discussion and that dialogue is open, friendly and positive.

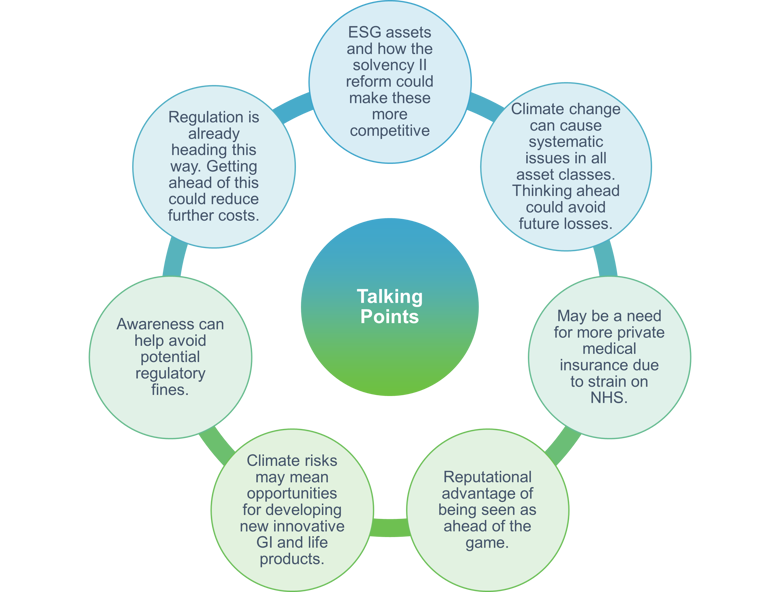

Below are some cross-industry talking points that you may find helpful to start with in challenging your own potential bias and how it may pertain to climate change.