The bulk annuity and pension risk transfer market

2016 saw the inaugural publication of Hymans Robertson’s Risk Transfer Report, which takes an in-depth look at the pension scheme de-risking market:

- The changes seen in terms of the insurers operating in the market;

- Insight on the strategies that insurers are adopting for selling bulk annuities;

- Impact of regulation on the market;

- How demand from defined benefit (DB) pension schemes is likely to change in the future.

This article outlines some of the key findings of the report which can be found in full here.

Bulk annuity insurers

There are currently eight insurance companies competing for pension scheme de-risking business. This follows Prudential’s decision to pull out of the market, and the merger of Just Retirement and Partnership, both of which happened earlier this year. Despite this, the level of competition is greater than we have seen in the recent past: four years ago there were only five insurers active in this market.

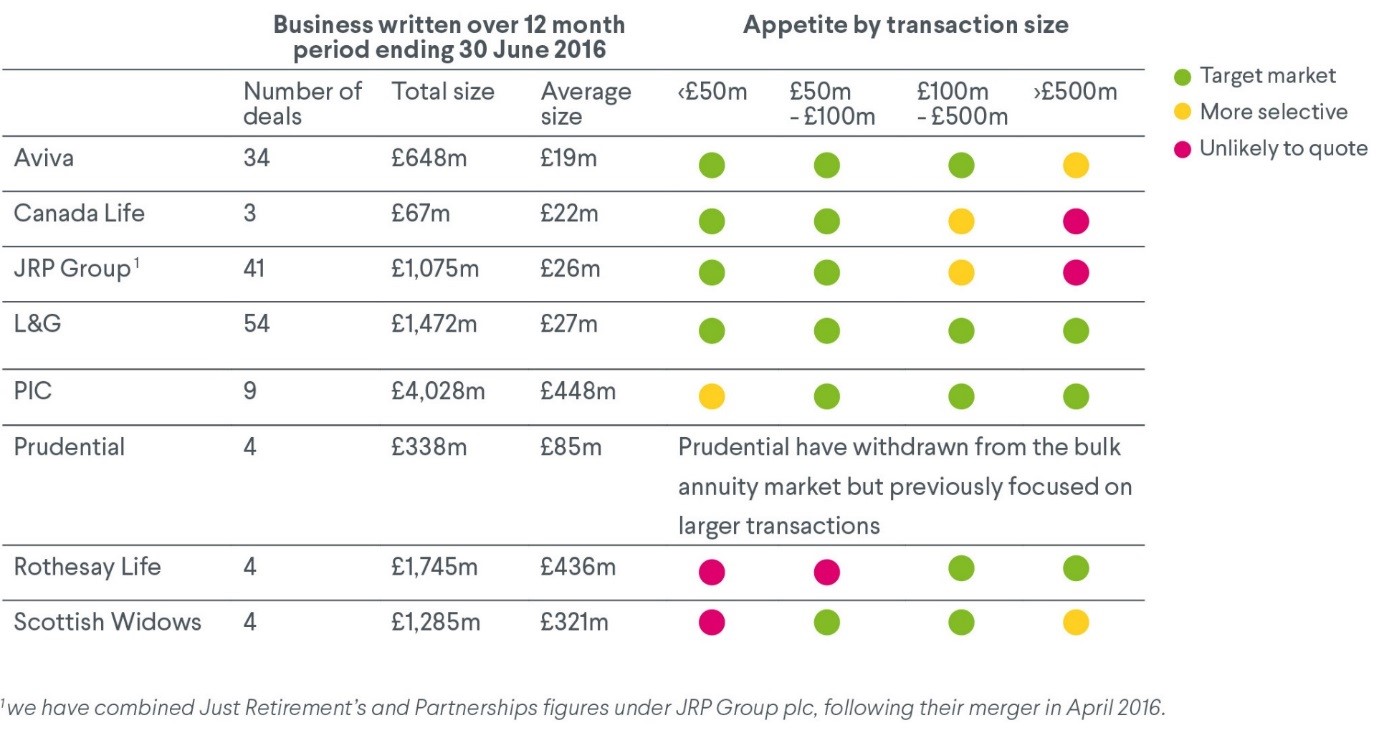

The table below summarises the current state of the market, both in terms of business written during the 12 months to June 2016, and in terms of appetite for future deals.

Canada Life and Scottish Widows both entered the bulk annuity market in 2015 in response to the material falls in individual annuity sales following the 2014 Pensions Freedom and Choice changes. Both insurers had strong appetites to quickly build a presence in the market. Indeed, Scottish Widows had a 12% market share over the 12 months to 30 June 2016, differentiated by competitive pricing that allowed pension schemes to earn a greater return on the money invested in a buy-in than could be obtained by holding Gilts to maturity. More established insurers inevitably had to refine their pricing in order to retain their market share in the face of increased competition.

Insurance company strategies

Solvency II has led to longevity now being something of a “Marmite risk” which insurers either love or hate – firms now generally either see annuities as being a core part of their business, or they don’t do annuities at all. This has led to an increase in sales of legacy annuity books, with Aegon selling its individual and bulk annuity portfolio in two slices in the first half of 2016 - £6bn of which was bought by Rothesay Life in April 2016 and the remaining £3bn bought by Legal & General in May 2016.

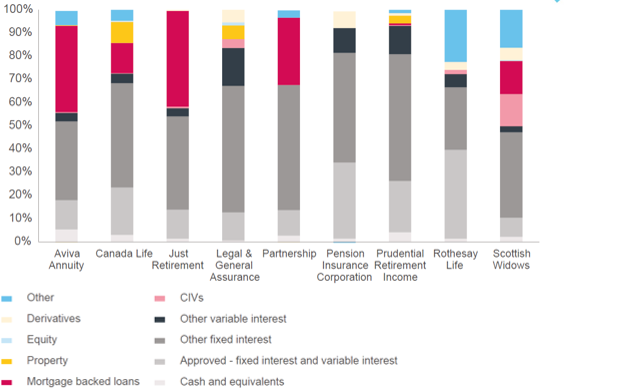

Solvency II has also focused attention on investment strategies for annuity business. Insurers have a range of assets that they can use to efficiently back their annuity book, ranging from Government gilts to some much more illiquid investments that provide a good match for their cash flow commitments. This is illustrated in the graph below, which shows the asset allocation for those companies that were most active in the pension scheme de-risking market during 2015.

Source: PRA Insurance Returns and Hymans Robertson research figures as at 31 December 2015 for all firms except Just Retirement, which is at 30 June 2015. For Canada Life, Legal & General Assurance Society and Scottish Widows, only the assets held in the non-profit fund have been included. For all firms, total assets in both Form 48 (non-lined) and Form 56 (index-linked) have been included. Please note for some companies (for the funds shown in the chart) there may be some assets backing non-annuity business.

Regulation

During 2015, some market commentators suggested that Solvency II would increase pensioner buy-in pricing by a few percent, with much higher price increases for bulk annuities that cover deferred members. In practice, however, we have not seen any discernible change to pensioner buy-in pricing as a result of Solvency II, and we have seen more modest increases to prices for bulk annuities that cover deferred members than were expected.

Insurers have been able to maintain competitive pensioner buy-in pricing by carefully revising their assets and longevity reinsurance strategies during 2016 to optimise their positions under Solvency II. At the end of June 2016, Hymans Robertson surveyed seven of the insurers in the bulk annuity market. All but one now expect to reinsure a material proportion (between 50% and 100% and on average over 70%) of the longevity risk associated with new buy-in transactions over the following year.

Demand from pension schemes

Pension scheme finances have been stretched for much of the last decade, compounded further by ultra-low long-term interest rates following the Brexit referendum. However, rather than sitting tight and waiting for financial conditions to improve, many schemes and sponsoring employers are taking proactive steps to address the problem and to capture opportunities to reduce risk in stages. There are many advantages to aiming to reach self-sufficiency via a series of well-planned buy-ins, rather than waiting to try to do it all in one go via a buy-out, one being that the demand from other pension schemes to complete buy-ins and buy-outs will inevitably grow.

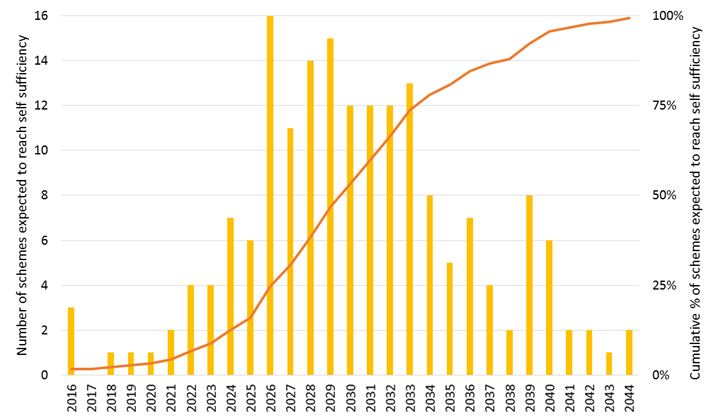

To analyse how quickly demand may grow in the future, Hymans Robertson analysed all of the DB pension schemes sponsored by FTSE 350 companies. In particular, we looked at how quickly the FTSE 350 sponsored pension schemes are likely to be able to reach a fully-funded, self-sufficient position. By that time, they will have been able to insure the majority of their liabilities via a series of buy-ins. The results of this analysis are set out in the chart below:

Half of the all of the pension schemes analysed are expected to reach self-sufficiency by 2030. The analysis also showed that there could be demand for up to £200bn of buy-in transactions from FTSE 350 companies over the next 10 years.

In conclusion

Solvency II has required many insurers to rethink their strategies, including which markets they are going to target, as well as their approach to investment and reinsurance. However, for those insurers that have decided to remain in the annuity market, pension scheme de-risking business seems likely to grow significantly over the next 10 years. This has the potential to replace much of the individual annuity business that has been lost following the advent of Pensions Freedom and Choice.

We are keen to discuss how our experts can help your business make the most of opportunities in the pension scheme de-risking market. Please contact one of our experts: