Buy-in and buy-out volumes hit £27.7bn over 2021

17 Mar 2022

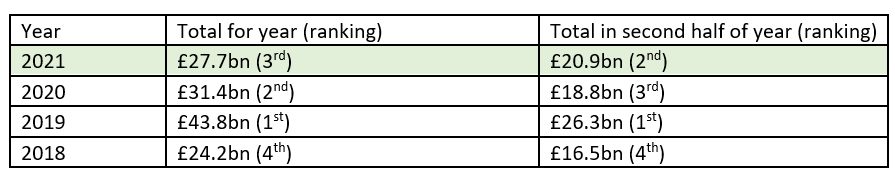

Hymans Robertson confirms that total pension scheme buy-in and buy-out volumes reached £27.7bn in 2021, the third highest year on record.

After a slow start to 2021, £20.9bn of buy-ins and buy-outs completed in the second half of the year, the second highest ever total for a six-month period ending on 31 December.

2021 was a successful year for defined benefit (DB) pension schemes looking to transfer risk to the insurance market, despite the continuing backdrop of the pandemic. A steady increase in demand for small and medium-sized transactions, along with transactions of over £1bn for Metalbox, Imperial Brands and Gallaher, created a busy period for buy-ins and buy-outs in the second half of 2021.

The confirmed volume of £27.7bn took place across almost 100 transactions during 2021, with approximately 75% of that volume being in relation to buy-ins and the remaining 25% relating to buy-outs.

James Mullins, Head of Risk Transfer at Hymans Robertson, comments:

“A quiet start to 2021, combined with increased innovation in the longevity hedging space for non-pensioner members, led to some very attractive buy-in and buy-out pricing for DB pension schemes who approached the market during 2021. Most of the insurers were behind their targets by mid-2021 and this created particularly strong competition in the second half of the year. This was a key reason why the second half of 2021 was the second busiest ever six-month period for buy-ins and buy-outs.

“The rapid growth in demand for pension schemes to insure their risks, along with improved pension scheme funding levels, attractive insurer pricing and new alternative risk transfer options, means that we expect around £50bn a year of buy-ins and buy-outs on average over the next 10 years. That means that, by the end of 2031, £1 trillion of pension scheme liabilities will have been insured, covering 5 million members’ benefits."

A copy of Hymans Robertson’s 2021 Risk Transfer report can be accessed here for more detail on developments in the bulk annuity market.

0 comments on this post