SIXTY SECOND SUMMARY

LGPS impact of State Pension Age review

07 Jun 2022

The latest State Pension age (SPA) review continues with evidence submitted for the independent review process. With another year until the outcome of the review is published, we consider how the evidence gathered so far, and any changes to the SPA, will be relevant to the LGPS.

Where are we now?

The SPA for new pensioners is currently 66 years for both men and women born between October 1954 and April 1960, incrementally increasing to 68 years for people born after 5 April 1978.

The Pensions Act 2014 requires the State Pension Age (SPA) to be reviewed every six years. This allows the Government to consider any change required to the SPA to achieve fairness between generations and to allow individuals to plan for their financial future.

In February 2022 Baroness Neville-Rolfe DBE CMG published a consultation calling for evidence for her independent report; this is one of two reports that the Secretary of State for Work and Pensions is obliged to commission, the other being from GAD with analysis of the most up-to-date projections of life expectancy.

What is under review?

The review concerns the pace of the increase to 68 years, rather than any further increases to the SPA itself. Currently SPA will become 68 years on 6 April 2046. However, the first review of SPA in 2017 concluded that the Government under the current review should decide whether to bring that implementation date forward to 6 April 2039.

The aim of the review is to consider the appropriateness of the SPA, recognising that any change will have an uneven impact across individuals and society.

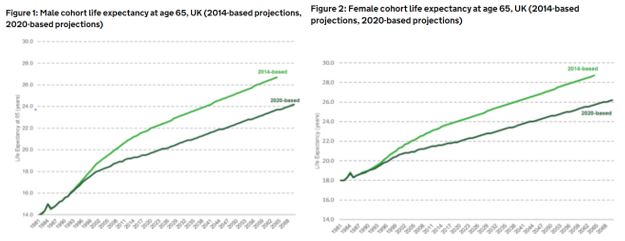

In the years since the first review carried out in 2017, the growth in life expectancies has slowed down. The ONS analysis provided in the call for evidence (Figures 1 & 2 – see below) shows that life expectancy is still trending upwards, but less quickly than before. This suggests that we should be less optimistic about how long people will live in the future.

Source: Second State Pension age review: independent report call for evidence

What does this mean for the LGPS?

The ONS analysis of general UK life expectancies are interesting and certainly affects the wider population but, crucially, it’s not directly relevant for LGPS scheme design or contribution levels. Each LGPS fund sets their own bespoke mortality assumptions, with analysis focussed on the people actually participating in the LGPS.

For the LGPS, the State Pension Age review is far more relevant to the “other end” of retirement, i.e. when benefits start rather than when they end. The normal pension age of benefits earned from April 2014 are linked to SPA so any change will have more impact on members of working age, who already have a higher expected SPA than retired members and who are likely to accrue a higher proportion of CARE benefits than legacy final salary related benefits.

However, the potentially affected cohort of members is small – only people born between 1971 and 1978. Even the oldest still has 17 years to plan ahead for a possible delay of up to one year to their state pension.

In isolation, an increase in SPA would tend to reduce LGPS employers’ costs since the benefits will be paid out for less time. The impact on employers will depend directly on individual membership profiles (and what members choose to do) but with only a small cohort in scope, this won’t be a significant driver of funding plans.

Future LGPS cost management exercises will look at the cost envelope after any future change to SPA is implemented. It’s very unlikely this could move the dial on the outcome, with many far more significant issues at stake.

Is an LGPS benefit entitlement based on member ages…problematic?

The active members in the LGPS span decades in age, all accruing the same 1/49th of pay each year but expecting to receive their benefits at some age between 66 and 68, depending on how old they are now. So, is this the next age-related discrimination challenge for the LGPS? Almost certainly not. This element of the post-14 scheme design always had this specific intention, to try to maintain some fairness between generations with a focus on how long members can expect to receive their benefits, rather than when they start.

What next?

The evidence to accelerate the increase to SPA is weaker now than at the last review in 2017, with many calls to scrap the planned rises let alone consider accelerating them. We don’t expect any significant impact on the LGPS due to the small number of people affected and the timescale for potential changes. We’ll keep you up to date with any developments and you can speak to your usual Hymans contact at any time.

0 comments on this post