Market performance update up to 18 May

20 May 2020

Our Capital Markets Update sets out our view of economic and market developments in Q1, in particular the dramatic effect of the spread of coronavirus on financial markets since the last week of February. This weekly update shares subsequent developments

Overview

This blog concentrates on subsequent developments and is updated weekly. Last week’s highlights included:

- The first official estimate of first-quarter UK GDP showed a fall of 2% from the previous quarter.

- May’s survey by Consensus Economics confirmed that global economic forecasts have become gloomier in recent weeks; the forecast fall in global GDP in 2020 has risen to 4.1% from 2.1% last month.

- In spite of these economic headwinds, oil prices rose again. It appears that the implementation of supply cuts agreed between oil producing countries last month may be more effective than many commentators had expected.

- The behaviour of other markets was more consistent with a gloomier economic outlook: equity markets fell back; speculative-grade credit spreads widened; sterling weakened; gold climbed back close to its mid-April high.

Economic Background

The first round of official estimates of Q1 GDP growth was completed by Japan (-0.9%) and the UK (-2.0%), following earlier releases by the US (-1.2%), Eurozone (-3.8%) and China (-9.8%). The Office for National Statistics noted that the challenges of data collection during the pandemic made the estimate more uncertain than usual. Europe, the UK and the US – broadly in that order – went into lockdown only during March.

These lockdowns will have had a more significant effect in the current quarter, and so the falls in GDP are likely to be even greater. In May’s Monetary Policy Report, the Bank of England suggested UK GDP might fall by a further 25% in the second quarter from its first-quarter level and by 14% in 2020 relative to 2019. Forecasts for global GDP growth in 2020, as a whole, have fallen significantly in recent weeks.

May’s survey by Consensus Economics showed an average fall of 4.1%, compared to 2.1% in April’s survey. Forecasters are also becoming less positive about the scale and speed of post-lockdown recovery. The forecast level of GDP in 2021 has fallen across the world. It's now substantially below 2019 levels for most major economies.

The effect of the pandemic on inflation could be complicated. A collapse in demand is almost inevitably deflationary, but could be offset this time by a much-reduced supply of goods and services. In any case, it will be difficult to interpret inflation numbers in the short term, because the pattern of actual consumer expenditure will be very different from that assumed in the basket of goods and services that underlie inflation indices.

Forecasters assume, on average, that inflation will fall in 2020 before bouncing back a little next year. Much of this year’s decline will reflect a much lower level of oil prices.

Market Update

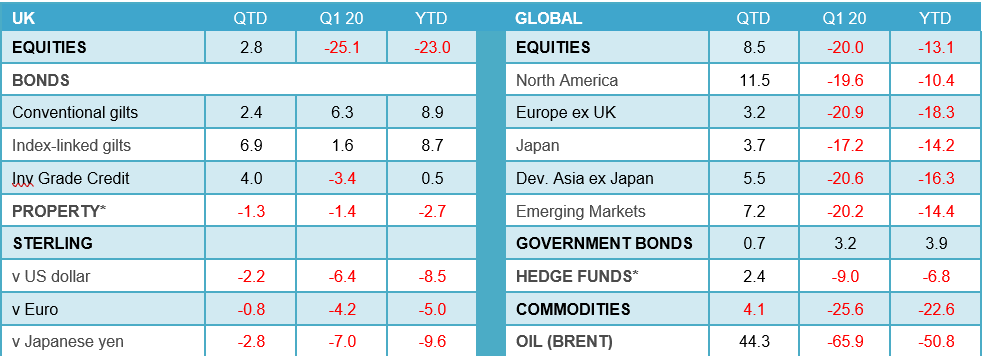

The table below highlights some of the market movements since the beginning of the year:

Equity markets

Global equity indices fell by 2% last week. While they are still almost 9% ahead so far this quarter, they are back to levels reached as early as mid-April, following a three-week rally of over 20% from the lows of late March. Volatility fell sharply as markets rallied, but it has remained stuck at still-high levels since late April. Relative sector performance in last week’s setback followed the pattern of the decline so far in 2020.

Energy and financial stocks performed poorly; consumer and technology stocks proved most resilient. Performance for this quarter shares some of these features. Financials are near the bottom of the rankings; consumer and technology stocks are near the top of the rankings; but energy and mining stocks have also done relatively well.

UK Property

Most property funds have now suspended dealings and with little, or no recent, transaction activity in the market, property valuations may become an increasingly less useful guide to the market. With that in mind, we note the MSCI UK Monthly Property Index for April showed a fall in capital values of 1.8% for the month.

This was a little better than March’s 2.4% fall, reflecting a slower decline in retail, which was, however, still the worst performer in absolute terms. The average quarterly rent collection for institutional property funds was, on average, just over half of what it would normally have been.

Bond markets

After falling substantially in the first quarter, yields in the major developed global government bond markets have been relatively stable in the second. There was little movement last week, leaving 10-year yields almost unchanged from end-March levels in the US and a little lower in the UK and Germany.

Other bond markets were relatively quiet last week. Spreads on global corporate investment-grade indices were unchanged: 0.7% p.a. lower than they finished the first quarter, 1.8% p.a. higher than they finished last year. Spreads on equivalent speculative-grade (BB+ and below) indices widened marginally: they are now 1.3% p.a. lower than they were at the end of March and 4.1% p.a. higher than they were at the end of December.

Other markets

Brent crude has climbed back to almost $33, $10 above its end-March level but still only half of its end-2019 level. Prices rose last week, despite the more cautious tone in financial markets.

Sterling was weaker last week, following the fortunes of riskier assets as it has done throughout the crisis. It made modest gains at the start of the second quarter, but these have been lost in May and is now 1.5% below end-March levels.

Our view

Recent positive market moves have slightly reduced the apparent cheapness of global equity and credit markets but the outlook for corporate earnings and defaults remains very uncertain at this stage, with sentiment likely to remain fragile through the first half of 2020. Lockdowns are beginning to be relaxed as some economies pass the peak of infections, but the sudden stop to global activity is now expected to generate the most severe recession in living memory and the restart is unlikely to occur quickly.

Furthermore, unprecedented fiscal and monetary policies may provide short term liquidity and ease market stresses, but they may be unable to halt rising unemployment or prevent insolvencies in the deep downturn entered.

We continue to advocate holding more cash than usual, with a view to reinvest with greater certainty at some point in the future. Just as importantly, in a period when market activity could be depressed for some time, there's a need for caution in meeting liquidity requirements associated with outgo as well as the collateral management associated with settlement of interest rate and currency hedging strategies and other derivative positions.

0 comments on this post