Briefing Note

How many active members were there in the LGPS in 2012?

01 Jul 2020

Key messages

- The protections granted to a relatively small tranche of members back in 2014/15 are now to be broadened

- Data will need to be collected from employers going back to 2014/15

- Challenges arising from the administration, communications and project management of the process are likely to be significant

In 2012 there were almost 2 million active LGPS members across the UK. Around 1.2 million* of those were under the age of 55.

“So what?” I hear you asking.

Well, the Court of Appeal has ruled (McCloud and Sargeant) that the Government’s 2015 public sector pension reforms unlawfully treated existing public sector employees differently based upon members’ ages on the 1 April 2012. So this number could represent the increase in the number of members likely to be covered by the broadening of the protection.

*based on GAD and NILGOSC data after adjusting for leavers to 2014 (2015 Scotland) 2014/2015.

You will recall, in the LGPS, active members who were within 10 years of their normal pension age on 31 March 2012 were protected via a statutory underpin. Those who meet the criteria for the underpin receive the better of their CARE pension or one calculated under 2008 scheme rules (2009 for Scotland), for any service up to 31 March 2022.

Due to the fundamental differences between CARE and final salary schemes, the record keeping requirements are not the same. To enable the underpin calculation to be performed, both sets of requirements apply. Knowing this in advance, though an additional administrative burden, is one thing but doing it retrospectively back to 2014 (2015 for Scotland) for 1.2 million members could seem like a daunting task for employers and administrators.

“But what about those members who have already left the scheme: retirements, deferreds, deaths, transfers?”

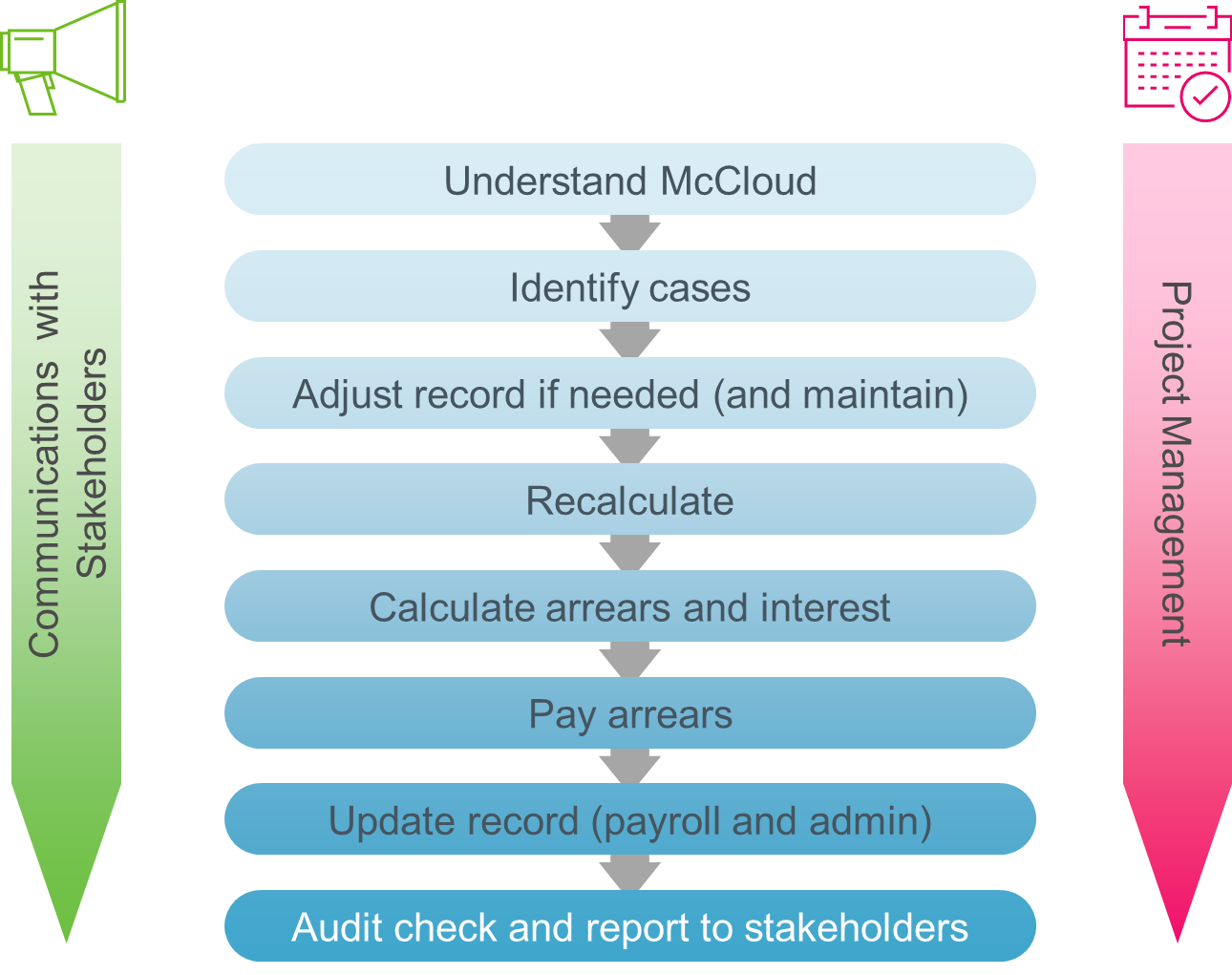

The remedies for these scenarios are yet to be determined but it is probably safe to assume there will be a process of identification, record adjustment, recalculation, comparison, payment adjustment, arrears calculation and payment, possibly with interest.

When should funds start the data gathering?

There is no time like the present! A consultation document is expected to be published before the UK Parliament’s Summer Recess (21 July) and funds should use that time to begin the process of obtaining the data from employers that they will need to apply the retrospective underpin.

Communicating the changes

The communications piece will not be insignificant with the appropriate level of information for the likes of pensions boards, employers, payroll, administrators, HMRC and receiving schemes, to mention a few, requiring drafting and issuing. So many moving parts for so many members will require robust project management to ensure all cases are dealt with correctly, recorded as such, and progress reported to the relevant stakeholders.

Funding and interaction with the cost management valuation

Generally, in line with SAB guidance, funds in England and Wales made an approximate allowance for the funding impact of McCloud at the 2019 LGPS valuations. The 2020 valuations in Scotland will also take account of the potential change in benefits. The SPPA’s letter of 13 May 2020 to administering authorities outlined the suggested approach and assumptions for Scottish funds to build into liability calculations. Depending on the actual nature and cost of any remedy, funds may need to consider if adjustments to employer contribution rates are required before the next round of funding valuations.

The interaction between McCloud and the national cost management process will also need to be resolved. Whether the cost management process takes into account any remedies as a result of McCloud will depend on the outcome of the current legal challenge recently lodged by some trade unions. This may result in:

- resubmission of the existing proposals

- a reviewed package taking into account the cost of any remedy; or

- no further scheme changes.

We are already providing support on the ruling to funds and their employers and are continuing to look into the further challenges that the ruling presents. If you need a hand please speak to your usual contact at Hymans.

Look out for our McCloud webinar

We’ll be hosting a webinar on 14 July on the impact of the McCloud ruling. Experts will be on hand to discuss how it can be costed and the areas that funds should focus their resources on to implement the Government’s remedy. Please keep an eye out for the invitation but in the meantime, you can register here.

0 comments on this post