Costs and Charges: How much is too much?

29 Oct 2021

Our industry by its very nature is full of figures, facts, analysis and statistics. As pension professionals we rely on a myriad of information from different sources in different forms to help us draw conclusions and give advice. Translating this sea of information however, into a form which members can understand is often a far more difficult challenge but one nonetheless being embraced by Ruston Smith, non executive Chairman of the Tesco Pension Fund.

Conscious that the industry is working towards introducing Simpler Benefit Statements, cross-industry research which Hymans Robertson supported and was led by Ruston was released last week. The research looked in particular at what members want to see presented to them in their benefit statements specifically around costs and charges.

Commenting on the research, Ruston said: “Not surprisingly, it’s the value of members’ savings at retirement that matters most – the money in their retirement pot…But members also want to see the costs that are charged and taken out of their savings on all their annual pension statements - presented in a consistent, clear and simple way, in pounds and pence.”

The research, which was undertaken by Ignition House, covered over 1,000 members of DC schemes, using a quantitative and qualitative research process.

So What's the Problem?

FMCs, AMC, TERs – as an industry we love a (TLA)! (we can argue about whether these are true Three Letter Acronyms separately!). Trying to obtain comparable costs and charges for products can sometimes be a challenge even for us as professionals. Just have a look at the continuing difficulty of obtaining some of this information in relation to Chair’s statements and you can see that these difficulties still exist even after the introduction of costs and charges disclosures several years ago. It’s not surprising therefore that members do not understand what they are looking at or what is reasonable to expect in terms of charges in relation to their pension.

Rather than assuming what members wanted to see and how they wanted it expressing, this research initiative was based on ‘asking the customer’ (ie savers) for their views. From the research undertaken, it was discovered that when looking at the simpler annual benefit statement template, members were less drawn to the charges section of the statement than their savings value. More worryingly some members believed that if no charge was shown, then no charge was payable or being deducted.

Providing information on costs therefore is important and when members were shown the charges which applied however, members were then very keen on transparency and consistency.

Transparent Charges: The Member Perspective

So Why Don't We Show Charges Clearly and Consistently?

At present there is no industry standard for how to present cost and charge information in benefit statements. Due to the differences in the way charges are constructed for different funds, whether there are platform charges, administration charges etc make it difficult to compare one charge with another. Different providers therefore do different things which no current benchmarking of services and costs readily available across the industry.

Complexity of the information is one part of it however another is also partly due to concern that a little information can be dangerous. Provision of costs without context, what they represent or appropriate comparisons can be dangerous and can lead to poor member decisions. Historically, there has been a fear in the industry that if the information presented is not fully understood it may result in members choosing to opt out of their pensions (the opposite impact to the intention of auto-enrolment!).

The research however suggests that industry concerns about the unintended consequences of showing charges on statements may be exaggerated, as just one in five (19%) of the research participants were genuinely surprised to see a charge for their pension and the rest intuitively knew that this would be the case. Those that were surprised are more likely to ask more questions.

“Industry concerns that transparent charges on statements might lead to higher opt-out rates seem unfounded” concludes the research but recommends the industry helps members to clearly and simply understand what they get for the charges they pay – and how providers and schemes have looked to improve financial outcomes net of those costs.

How Interested in Charges Are Members When They Know About Them?

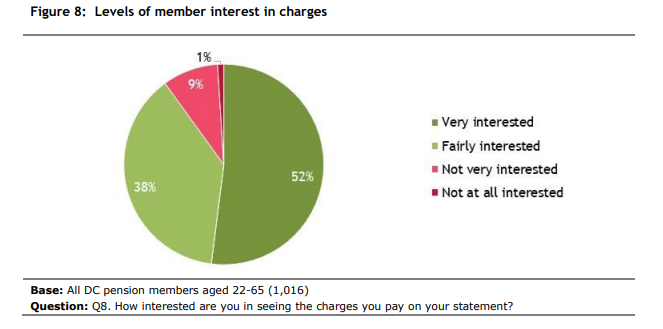

The research shows conclusively that once members were made aware of the charges, the interest in them increased significantly.

“Once members are aware that there are charges, only 1% are not at all interested in seeing these on their statements. A whopping 86% of those currently with low levels of engagement expressed interest, and 44% of this group said they were very interested.”

Not surprising you might suggest but what then do people do with that information once they see it?

When charges are highlighted members clearly want to understand what the charges are and what those charges pay for. If the charges are split between investment costs and administration costs for example and the administration costs are the higher portion, members might well questions whether that is a reasonable split!

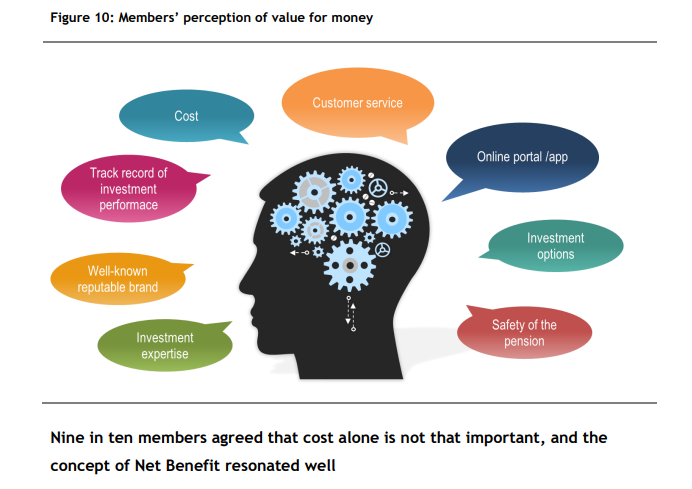

The costs in isolation however are only one part of the puzzle. We are all familiar in our daily lives with various comparison sites which we can use to benchmark insurance quotes, mortgages etc and most of us have become quite proficient at using them to understand not only cost comparison but to understand whether the services you therefore get as a result are the same as each other. The Australian pensions market already has a similar concept for pensions.

The Australian pensions industry is significantly more mature than the UK market so is always a good forward looking lens for how things potentially may evolve. Due to standardisation of reporting of costs and charges, members are now able to readily and accurately compare one pension with another to determine where the greatest net benefit lies. The UK market does not yet have this level of sophistication across the board but it is developing. Interestingly, the research revealed there was a good understanding of what “net benefit means” by the participants and that the focus is not and should not solely be on cost.

So What Do Members Want to See?

Several key messages from members about what they wanted to see came out of the research:

-

Members have a preference for a breakdown between admin and investment - rather than a single charge

-

Members wanted to see charges in pounds and pence

-

Members wanted to see amounts in numbers rather than words

-

Expressing the charges in pounds and pence for every £100 of savings makes them easier to digest

-

Members take a dim view of schemes which cannot provide an individual charge

Given that members have made it clear what they want and how they want to see it the challenge is now up to us as an industry of professionals to provide that.

What's Next?

The drive towards Simpler Benefit Statements is one I’m sure the majority of us as members and professionals all welcome. The current statements have become vey unwieldy and regulatory in focus. As the developments continue to make statements simpler, so too will the clarity of messaging over costs and charges and overall value (which thankfully members in the research realised wasn’t all about cost). There are several opportunities here for us as an industry to not only improve overall member outcomes but to increase engagement through consistent, transparent and easy to understand messaging. It’s not surprising that if we don’t communicate clearly we don’t get good understanding, good decision making and essentially good member outcomes. It’s the essence of consulting really. Now is our chance to get that right when it comes to costs and charges!

To discuss this blogs themes in more detail get in touch with alison.leslie@hymans.co.uk

0 comments on this post