A volatile transfer window

15 Nov 2021

It’s fair to say that the last 21 months have been a bit different. We’ve all had to get used to new ways of working, socialising and sanitising. Perhaps it’s given people a chance to stop and reflect, and use some of their free time to sort out the life admin that just hadn’t got to the top of the priority list. And as a pensions actuary, it would be remiss of me not to suggest that taking the time to understand and monitor your pensions savings should be top of this personal finance list!

For those individuals lucky to have a DB pension entitlement built up in a previous employment, people often consider whether taking a transfer value (TV) is the right thing to do. I’m not going to get into the potential benefits and drawbacks of taking such a transfer, that’s a matter for a member and their financial advisor, but I thought it would be interesting to see what has happened to the value of a typical transfer value since the start of last year.

Even if looking after your savings is high up on your to-do list, creating your own annuity spreadsheet to track your TV probably won’t be. So, we’ve done it for you. It tracks how a TV changes for a current 55-year-old, who is expecting to retire in 10 years’ time with an inflation-linked pension.

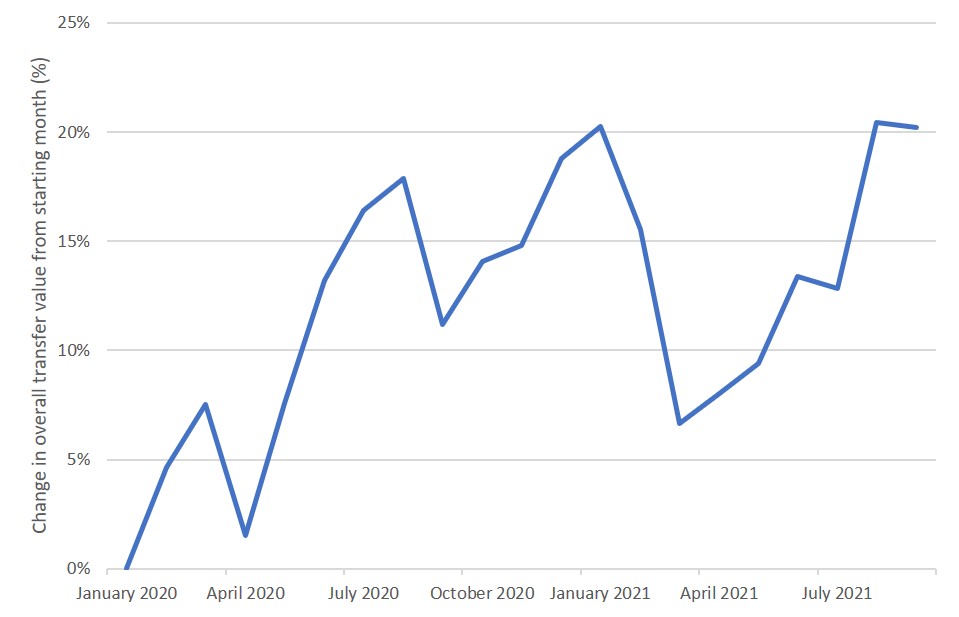

When I looked at how TVs moved over since early 2020, a few things struck me:

- If you’re a member of a pension scheme, your TV can change very quickly. For example, you could have taken 15% more cash by delaying your TV by only three months from April to July 2020.

- This is crucial as your formal TV quote is guaranteed for three months. You are normally entitled to one free transfer value quote a year, but you can usually pay a relatively small fee to get a requote. If you have already decided to take your TV and markets have moved the right way, it may well be worth taking this option, even if your TV is only a modest size.

- If you’re a trustee, helping members understand the rapidly changing value of their benefits can help them make the right choices at the right time. This is something I’m passionate about and why we’re helping a number of our clients produce TVs in bulk every month to display to members automatically on their administration portal.

- On the other hand, volatile markets can be a financial risk for pension schemes if members wait out falls in market values during the guarantee period – just look at the first couple of months of 2021 when TVs fell by nearly 15%.

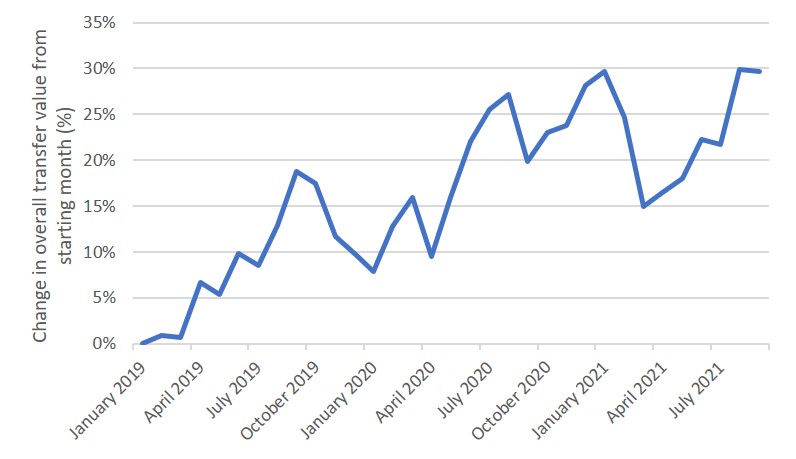

- If you think that a 15% change in TVs in 3 months is just a blip, you’d be wrong. You can see from the chart below that in summer 2021, transfer values were a staggering 30% higher than the equivalent member would have got back in early 2019.

Now of course the transfer value is only one side of the story, as those members who are still buying an annuity to fund their retirement income would also see an increase in pricing, therefore in theory the retirement income they received would have been broadly stable. However, since the introduction of Freedom and Choice back in 2015, more and more members are choosing income drawdown as an option and so depending on their timing of receiving a transfer value could have seen substantial differences in their available retirement funds and the lifestyle they can afford.

And for those who did find the time to take some action on their pension savings over the last 21 months, perhaps they did the right thing by baking the banana breads first and looking at their pensions towards the end of the period?

0 comments on this post